Alaska Airlines Visa® Signature Card Review: Earn 60,000 Miles

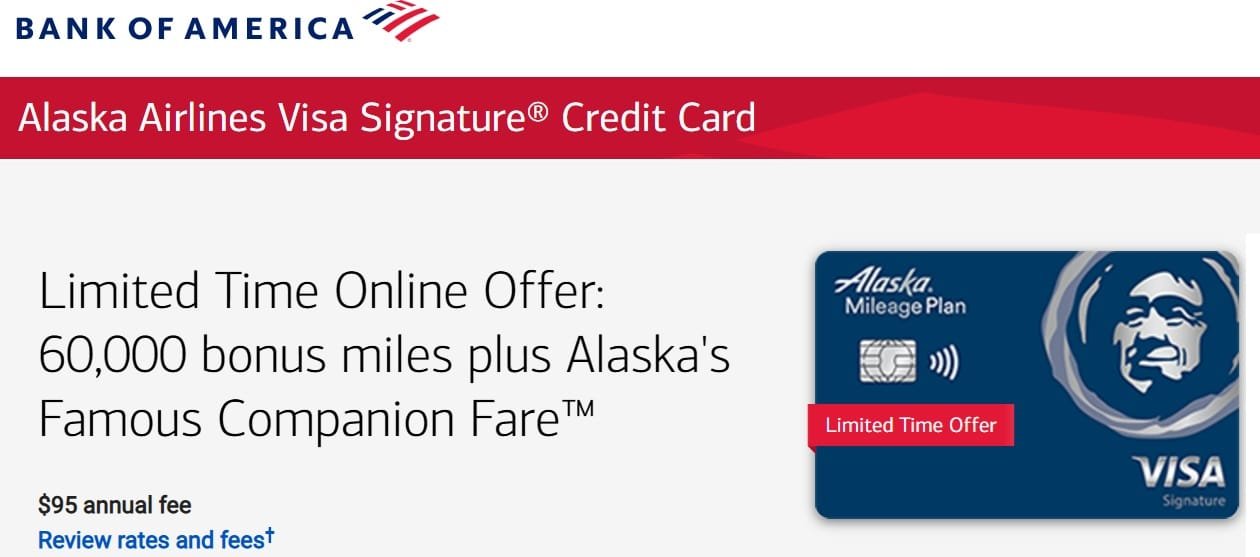

Get more out of your travel with the Bank of America Alaska Airlines Visa Signature Card. Earn 3 miles per dollar spent on eligible Alaska Airlines purchases, 2 miles per dollar on select categories, and 1 mile per dollar on other purchases. With a $95 annual fee, this card offers a limited-time bonus offer of 60,000 miles and an annual companion fare. Plus, enjoy a competitive APR of 20.49%-28.49% variable and an annual benefit of a companion fare from $99 after meeting spending requirements.

Table of Contents

Alaska Airlines Visa signature®Card Review

If you’re a regular traveler with Alaska Airlines, the Alaska Airlines Visa Signature Card could be an ideal choice for you. Offering a range of attractive rewards and benefits, this card can help you improve your flying experience while earning miles for your next trip. Here’s a detailed review of the Alaska Airlines Visa Signature Card.

Quick Highlights:

- Earn 60,000 bonus miles and a $99 Companion Fare™ ($23 taxes and fees) by spending $3,000 in the first 90 days.

- Receive a companion fare each year after spending $6,000 within the prior anniversary year.

- Earn 3 miles per $1 on eligible Alaska Airlines purchases, 2 miles per $1 on select purchases.

- Get 1 mile per $1 on all other eligible purchases.

- Enjoy a 10% rewards bonus on miles earned from card purchases with an eligible Bank of America® account.

- No foreign transaction fees and a low $95 annual fee.

Rewards of Alaska Airlines Visa Signature Credit Card

- Earn 3 miles per $1 on eligible Alaska Airlines purchases.

- Get 2 miles per $1 on gas, EV charging, transit, ride-sharing, cable, and select streaming services.

- Earn 1 mile per $1 on all other eligible purchases.

- Receive a 10% bonus on miles earned if you have an eligible Bank of America® account.

- Earn 60,000 bonus miles with Alaska’s Famous Companion Fare™ after spending $3,000 in the first 90 days.

These rewards and bonuses make this card a great option for those who frequently travel with Alaska Airlines.

Redeeming Miles on the Alaska Airlines Visa Credit Card

The Alaska Airlines Visa Signature Card lets you redeem miles for flights, upgrades, vacation packages, and more. However, Alaska Airlines has fewer partners than other major airlines, so redeeming miles for partner flights may be limited.

For luxury travel, Alaska offers low redemption rates for first- and business-class flights.

For example, short-haul flights, like Seattle to San Francisco, start at just 5,000 miles. A Seattle to New York City flight costs 12,500 miles in economy, while first-class starts at 40,000 miles for longer domestic flights. Travel to Hawaii starts at 15,000 miles for economy and 40,000 miles for first class each way.

Alaska’s global partners, such as British Airways, Cathay Pacific, Qantas, and Singapore Airlines, offer more travel options. Though mileage rates may not always be the lowest for partner flights, you can enjoy a free stopover on one-way award tickets.

To maximize redemptions, consider booking first-class with Cathay Pacific or Japan Airlines for 70,000 miles one-way, or flying business class to Fiji with Fiji Airways for only 55,000 miles. You can even add a free stopover in Fiji when flying to Australia for the same amount.

Alaska Airlines also offers great domestic deals, with flights starting at just 5,000 miles each way. Whether flying domestically or internationally, the Alaska Airlines Visa Signature Card provides excellent value for travelers. If you love flying with Alaska Airlines and want to enjoy luxurious awards, this card is a great option.

Alaska Airlines Visa Signature Redeeming Awards Flights

You can redeem your miles for award flights with Alaska Airlines and its global partners. It also offers the option to purchase first-class upgrades with miles, starting at 15,000 miles each way.

Intro Offer

As part of the limited-time online offer, new cardholders can earn 60,000 bonus miles and Alaska’s Famous Companion Fare™ ($99 fare plus taxes and fees from $23) by spending $3,000 or more within the first 90 days of opening their account.

Rates and Fees

- Balance Transfers Intro APR: N/A.

- Purchases Intro APR: N/A.

- Regular APR: 20.49%–28.49% Variable APR on purchases and balance transfers.

- Balance Transfer Fee: $10 or 4% per each transaction.

- Low Annual Fee: $95.

- Penalty APR: up to 29.99% APR.

- Direct Deposit and Check Cash advance fees: $10 or 3% of the amount of each transaction.

- Overdraft Protection Cash Advance (if enrolled): $12 per transaction.

- ATM, Over-the-Counter, Cash Equivalent Cash Advances: Either $10 or 5% per transaction.

- Foreign Transaction Fees: None

Alaska Airlines Visa Signature Prequalification

You can check if you prequalify for the Alaska Airlines Visa Signature Card with a soft credit pull that won’t impact your credit score.

Alaska Airlines Signature Visa Credit Limit

The credit limit for the Alaska Airlines Visa Signature Card varies depending on various factors such as credit history, income, and more. The card issuer will determine your credit limit at the time of approval. Typically, the credit limit can range from $5,000 to $15,000. However, some cardholders may receive limits below $5,000 or above $25,000 depending on their financial profile. However, you can request the issuer to increase the credit limit, if it is lower than your expectations.

Note *: It is important to note that the credit limit can be increased by contacting the card issuer and providing proof of income and other necessary information.

Credit Score Needed For Alaska Airlines Signature Visa

The card is generally geared towards those with good to excellent credit scores. This means a FICO score of 670 or above, although the exact credit score requirement may vary depending on other factors such as income and credit history.

However, it is recommended that applicants have a higher credit score to increase their chances of approval and receive a higher credit limit. It is also important to maintain a good credit score to continue receiving the benefits and rewards of this card.

Approval Odd: Alaska Airlines Signature Visa

As with any credit card, there is no guarantee of approval for the Alaska Airlines Visa Signature Card. The card issuer will review your application and determine if you meet their criteria for approval based on factors such as credit score, income, and more.

However, some steps you can take to increase your chances of approval include improving your credit score, providing accurate and complete information on your application, and having a steady income.

Additionally, it is important to note that if you are not approved for the card, you may still be eligible for other credit cards offered by Bank of America. Therefore, it is always recommended to have multiple options in case one does not work out. Overall, if you meet the criteria and have a good credit score, you have a higher chance of being approved for the Alaska Card and enjoying its many benefits.

Alaska Airlines Visa Signature Application Status

After submitting your application for the Alaska Airlines Visa Signature Card, you can check the status of your application online or by calling the card issuer’s customer service number. If there are any issues with your application, such as missing information or a need for further verification, the card issuer may contact you directly to resolve them.

Otherwise, you should receive a decision on your application within a few weeks. If you are approved, your card will be mailed to you and you can start using it to earn miles and enjoy its benefits right away.

In the case of a denial, you may receive a letter explaining the reasons for rejection and what steps you can take in the future to improve your chances of approval. You can also consider a second credit card or the Amazon credit card because its approval has minimum requirements.

Customer Service Phone Number

If you have any questions or concerns regarding your Alaska Visa Signature Card, you can contact the card issuer’s customer service team at 1-800-654-5669 during their operating hours: Monday to Friday from 7:00 am to 7:00 pm PT and Saturday from 8:00 am to 5:00 pm PT.

They will assist you with anything from general inquiries to specific account issues.

You can also access your account information and make payments through their online portal or mobile app, making it even easier to manage your card.

How to Apply Online

If you meet the criteria and are interested in applying for the Visa Signature Card from Alaska Airlines, you can easily apply online through the Bank of America website. Simply fill out the required information, including personal details and financial information, and submit your application.

Who Can Benefit from the Alaska Airlines Visa Signature Card?

The Alaska Airlines Visa Card is ideal for anyone who prefers Alaska Airlines as their carrier of choice and wants to improve their flying experience with airline-specific benefits. Additionally, this card is perfect for those who want to collect miles to unlock business- and first-class award flights for a low redemption rate.

Is the Alaska Airlines Visa Worth It?

The Alaska Airlines Visa Signature Card is a great choice for those looking to earn valuable Alaska miles. It offers a competitive earning rate on purchases and an annual companion ticket. With a low $95 annual fee, the card’s benefits make it worth the cost.

Whether you’re a frequent traveler or just starting to build your points portfolio, the card provides excellent value. The limited-time intro offer and ongoing rewards help you earn miles towards your next flight. Plus, with responsible use, the card can also help improve your credit score and financial stability.

If you’re an avid traveler or looking for valuable rewards, applying for the Alaska Airlines Visa Signature Card can be a smart move.

Features and Benefits: BOA Alaska Airlines Visa Signature Card

- The Alaska Airlines Visa Signature Card offers a variety of travel-related benefits that can enhance your experience.

- Travel Insurance & Protection This card includes several travel insurance benefits such as trip cancellation, travel accident, and baggage delay insurance. Cardholders also enjoy rental car collision damage waiver (CDW) and rental car coverage.

- Concierge & Travel Assistance The concierge service can assist with travel tasks like making reservations or finding local events. The card also provides 24/7 travel assistance services, including emergency translation, medical referrals, and lost luggage locator.

- Rental Car Coverage Enjoy rental car insurance through the card’s CDW letter, which can help you avoid paying extra at rental counters. This coverage protects against damage or theft of your rental car.

- Rewards Program & Referral Benefits Cardholders earn miles for every purchase, with bonuses for referrals. You can earn Alaska’s Famous Companion Fare™ after spending $3,000 in the first 90 days. Additionally, get a 10% bonus on miles with an eligible Bank of America® account.

- Exclusive Travel Perks The card offers benefits such as free checked baggage for the cardholder and up to 6 companions on Alaska Airlines flights. Additonally there is no foreign transaction fees, and free credit score access. It also provides lost luggage reimbursement and travel assistance services, including emergency cash and ticket replacements.

- Other Valuable Benefits Additional perks include extended warranty coverage, zero fraud liability, mobile pay compatibility, and roadside assistance. The card is also an unsecured credit card, which requires no collateral.

Bottom Line

The Alaska Airlines Visa Signature Card is ideal for frequent travelers who want valuable rewards and excellent customer service. New cardholders can enjoy a limited-time offer of 60,000 miles and a companion fare, providing great value.

With competitive earning rates and a low annual fee, this card is a smart choice for building points and miles. Apply today to start earning rewards for your next flight.

With responsible usage, you can also improve your credit score and financial stability, making it an all-around beneficial choice.

Further guides to consider:

FAQs: Alaska Airlines Visa Signature Card Review: Enhance Your Flying Experience

What Credit Score Do I Need for an Alaska Airlines Card?

To be approved for the Alaska Airlines credit card, a credit score in the range of 670-850 (Excellent/Good) is recommended. Keep in mind that meeting this criteria does not guarantee approval, as other factors are also considered in the application process.

How Do I Link My Alaska Airlines Credit Card Online?

To link your Alaska Airlines credit card online, log in to your Alaska Airlines Mileage Plan account and navigate to the “Bank of America Credit Card” section. From there, click “Add a Card” and follow the prompts to link your card.

Does Alaska Airlines Credit Card Reimburse For TSA Precheck?

Unfortunately, the Alaska Airlines credit card does not offer a reimbursement for TSA PreCheck or any other travel-related fees.

How to Refer A Friend For an Alaska Airline Credit Card?

To refer a friend for the Alaska Airlines credit card, log in to your account and navigate to the “Refer a Friend” section. From there, you can share your referral link via email, social media, or other channels.

How to Link Alaska Card to Mileage Plan?

To link your Alaska Airlines credit card to your Mileage Plan account, log in to your account and navigate to the “Bank of America Credit Card” section. From there, click “Add a Card” and enter your card information.

Does Alaska Credit Card Have Travel Insurance?

Yes, the Alaska Airlines credit card offers a range of travel insurance benefits, including trip cancellation/interruption insurance, travel accident insurance, and baggage delay insurance. Terms and conditions apply.

How to Get Alaska Companion Fare?

To earn the Alaska Airlines Companion Fare, you must spend $6,000 or more on eligible purchases with your credit card within the prior anniversary year. The Companion Fare can be used to purchase a ticket for a companion on the same flight as the primary cardholder for a discounted price of $99 plus taxes and fees from $23. To redeem the Companion Fare, log in to your account and navigate to the “Discount and Companion Fare Codes” section.

Specification: Alaska Airlines Visa® Signature Card Review: Earn 60,000 Miles

|