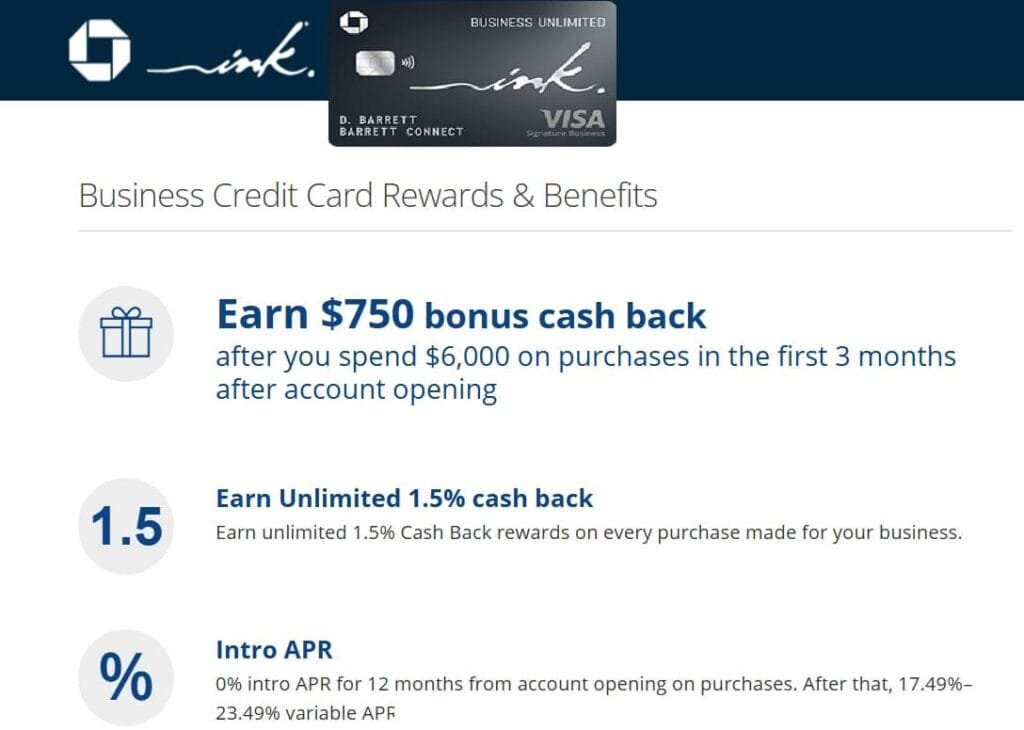

Ink Business Unlimited® Credit Card Review: Earn 1.5% Cash Back and $750 Bonus

Ink Business Unlimited Credit Card offers:

- $750 Cash Back Bonus: Earn after spending $6,000 in the first 3 months.

- Unlimited 1.5% Cash Back: Earn on every purchase, no limit.

- 0% Intro APR: For the first 12 months (then 18.49% – 24.49% variable APR).

- No Annual Fee: No cost to own the card.

- Free Employee Cards: Add employees at no extra charge.

- Bonus Cash Back on Lyft: Enjoy bonus rewards on Lyft rides through March 2025.

- Reward Redemption Flexibility: Redeem for cashback, statement credits, gift cards, or travel via Chase Travel.

- No Minimum Redemption: Redeem rewards with no minimum required.

Table of Contents

Ink Business Unlimited® Credit Card Review: A Comprehensive Guide to Benefits, Rewards, and More

If you’re a business owner looking for a credit card offering simplicity, substantial rewards, and valuable perks, the Ink Business Unlimited® Credit Card might be the perfect choice. In this detailed review, we’ll explore everything you need to know about this Chase business credit card, including its benefits, cash back rewards, APR details, and how it stands out among other business cards.

Why Choose Ink Business Unlimited® Credit Card?

The Ink Business Unlimited® Credit Card offers a straightforward approach to business spending. It gives you unlimited 1.5% cash back on every purchase, no matter what you buy or where you shop. Whether a small business owner or a seasoned entrepreneur, this card is designed to help you earn rewards effortlessly on all your business purchases.

This card comes with a $750 cashback bonus if you spend $6,000 in the first 3 months, making it an attractive option for businesses looking to boost their rewards.

Card Highlights

- Earn 1.5% Cash Back on every purchase, with no category restrictions.

- $750 Cash Back Bonus when you spend $6,000 in the first 3 months.

- 0% Intro APR on purchases for the first 12 months, then a variable APR of 17.49% – 23.49%.

- No Annual Fee—keep all your rewards without worrying about yearly costs.

- Employee Cards at No Extra Cost—add employees and earn rewards faster.

- 5% Cash Back on Lyft rides and memberships until March 31, 2025.

- Purchase Protection covers theft or damage for up to 120 days.

- Extended Warranty doubles the manufacturer’s Warranty on eligible items.

- Travel and Emergency Assistance helps with legal and medical referrals when you’re on the go.

- Roadside Assistance provides help during emergencies, like flat tires or dead batteries.

- Auto Rental Collision Damage Waiver covers damage to rental cars up to $60,000.

- Earn Rewards on All Business Expenses, including office supplies, advertising, and more.

Key Features of Ink Business Unlimited® Credit Card

Let’s break down the primary features of the Ink Business Unlimited® Credit Card:

- Earn $750 Cash Back: You can earn a $750 bonus after spending $6,000 on purchases within the first 3 months from account opening.

- Unlimited 1.5% Cash Back: Every dollar you spend earns 1.5% back, providing a reliable and consistent rewards rate for your business expenses.

- 0% Intro APR: The card offers 0% intro APR on purchases for the first 12 months from account opening. After that, the APR ranges from 17.49% to 23.49% variable APR.

- No Annual Fee: One of the standout features of the Chase Ink Business Unlimited is its $0 annual fee, making it a cost-effective option for businesses.

- Employee Cards at No Additional Cost: You can add employee cards to your account without incurring extra fees. This allows you to manage expenses more effectively while earning rewards faster.

- Lyft Cash Back Offer: Until March 31, 2025, you can earn a total of 5% cash back on qualifying Lyft purchases, which includes rides and memberships, alongside the standard 1.5% cash back on other purchases.

- Business Credit Card Protection: Built-in benefits like travel insurance, purchase protection, and extended warranties help safeguard your business purchases.

Cash Back Rewards: How Do They Work?

The Ink Business Unlimited® Credit Card is an excellent choice for business owners who prefer simple rewards. With this card, you earn unlimited 1.5% cash back on every purchase, regardless of the category. This makes it a solid option if you want a straightforward cashback business credit card without the hassle of tracking rotating categories or special offers.

Earning Cash Back with Ink Business Unlimited®

- Cash Back Rewards: You’ll earn 1.5% back on each dollar you spend. Whether buying office supplies, paying for advertising, or purchasing any other business-related expenses, your rewards will accumulate quickly.

- $750 Cash Back Bonus: If you meet the required spend of $6,000 in the first 3 months, you can earn a $750 cashback bonus. That’s 75,000 bonus points, which can be redeemed for cash back or other rewards.

- Lyft Bonus: You can earn 5% cash back on your purchases using your Chase Ink Business Unlimited card. This includes rides and subscriptions, which can benefit business owners who frequently travel via Lyft.

Redeeming Your Rewards

Once you’ve earned cash back rewards, you have plenty of options for redemption. You can:

- Redeem for Cash Back: This can be credited to your account or directly deposited into a U.S. checking or savings account.

- Gift Cards: You can choose from various gift card options to use your rewards for purchases at many popular stores.

- Travel: Use your rewards to book business travel through Chase Travel, including flights, hotel stays, and rental cars. Additionally, rewards points are redeemable through the Ultimate Rewards Chase portal for travel bookings.

- Apple Purchases: You can redeem points for Apple products through the Apple Ultimate Rewards Store, which includes items like iPads, iPhones, and MacBooks.

Additional Benefits of Ink Business Unlimited®

The Ink Business Unlimited® Credit Card is not just about earning rewards—it also comes with a wide array of perks to help manage your business expenses:

- Purchase Protection: Eligible purchases are covered against theft or damage for up to 120 days, with a maximum coverage of $10,000 per item.

- Extended Warranty: This benefit extends the manufacturer’s Warranty by an additional year on eligible products with a warranty of three years or less.

- Travel and Emergency Assistance: You get access to legal and medical referrals and other travel assistance services, which can be helpful if you travel frequently for business.

- Roadside Assistance: If your business involves driving, you can benefit from roadside assistance services for emergencies like a flat tire or dead battery.

- Auto Rental Collision Damage Waiver: You can decline rental car insurance and still be covered for theft or collision damage (up to $60,000 for most rental cars with an MSRP of $125,000 or less).

Chase Ink Business Unlimited® vs. Other Chase Business Credit Cards

If you’re exploring options for a business credit card, it’s essential to compare the Ink Business Unlimited® Credit Card with other popular Chase business cards:

- Chase Ink Business Preferred® Credit Card: This card offers a higher rewards rate on travel, shipping, and other select categories, but it comes with a higher annual fee.

- Chase Ink Business Cash® Credit Card: This card offers 5% cash back on the first $25,000 spent in combined purchases at select categories (e.g., office supply stores and internet/cable services). After the $25,000 limit, the rewards rate drops to 1%.

- Chase Ink Business Unlimited® Credit Card: This card is ideal for businesses that want a simple, easy-to-use cashback card with no rotating categories and no annual fee.

Why You Might Want a Different Card

While the Ink Business Unlimited® Credit Card offers solid benefits, it may not fit everyone best. The card earns a flat 1.5% cash back on all purchases, which is straightforward but might not maximize rewards for those who spend heavily in specific categories.

If you want to earn higher cash back on particular expenses, such as travel or office supplies, you might consider pairing this card with one that offers bonus rewards in those categories. This strategy could help you maximize your cashback potential.

The Ink Business Unlimited card also comes with a penalty APR of 29.99%, which kicks in if you miss a payment. This is significantly higher than many other business credit cards, which often reduce penalty APRs after 6 to 12 months.

If you’re concerned about staying on top of your payments or have a history of occasional late fees, you may opt for a business card that does not impose such a steep penalty APR. Staying disciplined with payments is crucial to avoid this costly fee and maintain your financial health.

Comparison of Ink Business Unlimited® and Other No-Annual-Fee Business Cards

It’s important to compare all the business credit card options that fit your business needs. The Ink Business Unlimited® card is a strong contender, but several other no-annual-fee cards also offer great benefits. Here’s a side-by-side comparison of the Ink Business Unlimited and three top competitors to help you decide which card suits your business best.

Comparison of Ink Business Unlimited® and Other No-Annual-Fee Business Cards

| Feature | Ink Business Unlimited | Bank of America® Business Advantage Customized Cash Rewards Mastercard® | Capital One Spark Cash Select | American Express Blue Business Cash™ Card |

|---|---|---|---|---|

| Sign-up Bonus | $750 after spending $7,500 in the first 3 months | $300 after spending $3,000 in the first 3 months | $500 after spending $4,500 in the first 3 months | $250 after spending $3,000 in the first 3 months |

| Rewards Rate | 1.5% cash back on all purchases | 3% cash back in a category of your choice, 2% on dining, 1% on others | 5% on hotels & rental cars through Capital One Travel, 1.5% on all other purchases | 2% cash back on up to $50,000 per year, then 1% |

| Annual Fee | $0 | $0 | $0 | $0 |

| Penalty APR | Up to 29.99% if late payments occur | No penalty APR | No penalty APR | Penalty APR applies if two late payments are made within 12 months |

| Cash Back Redemption | No limit on cash back, automatic deposits | Cash rewards don’t expire, can change bonus category monthly | No minimum redemption, can set automatic deposit | Rewards are redeemable any time, with a cap on annual rewards |

| Intro APR Offer | None | None | 0% APR for 12 months on new purchases | 0% APR for 12 months on new purchases |

| Bonus Categories | No categories, flat 1.5% on all purchases | 3% in a category of your choice, 2% on dining | 5% on travel purchases through Capital One | 2% on purchases up to $50,000 per year, then 1% |

Ink Business Unlimited vs. Bank of America® Business Advantage Customized Cash Rewards Mastercard®

The Ink Business Unlimited offers a $750 sign-up bonus after spending $7,500 in the first 3 months, while the Bank of America® Business Advantage Customized Cash Rewards Mastercard® gives $300 after spending $3,000 in 90 days. Though the sign-up bonus is smaller, the Bank of America card offers 3% cash back in a category of your choice, such as gas, office supplies, or travel. Additionally, you can earn 2% cash back on dining, capped at $50,000 in combined purchases annually.

On the other hand, the Ink Business Unlimited card provides a flat 1.5% cash back on all purchases, with no limits or category restrictions.

Both cards have no annual fee and significant benefits, but the Bank of America card is more forgiving, with no penalty APR and no late fee for balances under $100. If you miss payments, the Business Advantage card may be more accommodating.

Ink Business Unlimited vs. Capital One Spark Cash Select

The Capital One Spark Cash Select also offers 1.5% cash back on all purchases, similar to the Ink Business Unlimited. However, it offers 5% cash back on hotels and rental cars booked through Capital One Travel.

While the Ink Business Unlimited provides a $750 sign-up bonus, the Capital One Spark Cash Select offers $500 after spending $4,500 within the first 3 months. The Spark Cash Select card offers no minimum redemption amount and the option to deposit cash back once you reach a set threshold automatically.

Both cards have no annual fee, but the Spark Cash Select is ideal for businesses with travel expenses, providing more value for purchases made through Capital One Travel.

Ink Business Unlimited vs. American Express Blue Business Cash™ Card

The American Express Blue Business Cash™ Card offers 2% cash back on purchases up to $50,000 annually, then 1% afterward. This is better than Ink Business Unlimited’s 1.5% flat rate for all purchases.

However, the Blue Business Cash card has a spending cap of $50,000, while the Ink Business Unlimited has no such limit. Both cards offer introductory 0% APR on purchases for 12 months.

The main drawback of the American Express card is its penalty APR if you make two late payments within 12 months. If your business expenses stay under $50,000, the Blue Business Cash card may offer more rewards in the long run. However, Ink Business Unlimited is better for businesses with considerable expenses and no category restrictions.

How Do Businesses Use the Ink Business Unlimited® Card?

Businesses like Emily’s Maids have used the Ink Business Unlimited® card to gain valuable rewards, especially for travel. Greg Shepard, the owner of this maid service, shared how he used the card to rack up points. These rewards helped fund business and personal trips at no extra cost. So, you can use your business credit card for personal use.

Shepard advises other business owners to always pay off their balance in full. This helps avoid interest charges while still earning cash back. He also recommends treating the card as a tool for business expenses, as rewards add up quickly when using the card consistently. This card provides a simple and effective way for small businesses to manage costs and earn rewards.

How to Use the Chase Ink Business Unlimited® Card

To maximize the Ink Business Unlimited® card, ensure you meet the sign-up bonus requirement by spending within the first few months. Use the card for all business-related purchases, including expenses from your employees.

This helps you consistently earn 1.5% cash back. Additionally, pairing this card with premium cards like the Chase Sapphire Preferred® or the Chase Ink Business Preferred® allows you to transfer points for enhanced travel rewards.

This can offer a 25% boost in value, making the rewards more valuable when used for travel. Use the card regularly to maximize cash back and rewards.

Application and Approval Process

Requirements for Applying

You must meet the following requirements to apply for the Ink Business Unlimited card.

- Be at least 18 years old

- Have a physical U.S. address

- Have proof of enough income to make the monthly minimum payment

- Have a Social Security number or ITIN

- Have good credit or better.

Approval Process

After submitting your application, you can typically expect to hear back from Chase Bank within 7-10 business days. However, in some cases, it may take up to 30 days for a decision to be made. To check the status of your application, you can call Chase Bank at 1-800-847-2869.

Credit Score Requirements

To maximize your chances of approval, it is recommended that you have a personal credit score of at least 670-850 (good to excellent) or a business credit score of at least 75. This shows Chase Bank that you are financially responsible and can handle credit card payments.

Contact/Customer Service

- Helpline Number: 1-800-847-2869.

- Official Website: Chase Bank

Conclusion: Is the Ink Business Unlimited® Card Right For You?

The Ink Business Unlimited® card is ideal for small-business owners seeking a simple, no-hassle cashback card. With 1.5% cash back on all purchases and no annual fee, earning rewards without tracking specific categories is easy. The card also provides a generous sign-up bonus and an intro APR purchase offer. The card remains a great option if you pay your balance in full each month and avoid late fees. Pairing this card with another rewards card for businesses needing additional perks can maximize benefits. Whether you’re looking to build business credit, streamline your expenses, or earn cash back on everyday purchases, the Ink Business Unlimited® Credit Card is worth considering.

FAQs: Ink Business Unlimited Credit Card Review

Does the Ink Business Unlimited card have foreign transaction fees?

No, it does not have a foreign transaction fee.

Is the Ink Business Unlimited card good?

Yes, its broad range of features and benefits makes it an excellent choice for many businesses.

Is the Ink Business Unlimited card metal?

The card is not metal; however, it’s the card’s features that make it truly valuable.

Is Ink Business Unlimited Credit Card Right for You?

The Ink Business Unlimited Credit Card shines for:

- Businesses with diverse spending habits

- Frequent travelers seeking basic travel protections

- New businesses looking for a generous welcome bonus

- Companies seeking a no-annual-fee rewards card

What is the credit limit for the Ink Business Unlimited® Credit Card?

The credit limit on the Ink Business Unlimited® Credit Card will depend on factors like your creditworthiness, business revenue, and other financial details. There's no fixed limit stated, but Chase typically provides competitive limits to eligible applicants.

What is the $100,000 bonus on Chase Ink Business?

Some versions of the Chase Ink Business cards offer a referral bonus of up to 100,000 points per year for referring other business owners who are approved for a card. This can translate to up to $1,000 in cash back or other rewards.

Is Chase Ink Business Unlimited® hard to get?

Approval for the Chase Ink Business Unlimited® Credit Card depends on factors such as your credit score, business revenue, and other criteria. While it's not considered exceptionally hard to get, having a good credit history and stable business income will increase your chances.

What is the annual fee for the Chase Ink Business Unlimited® Credit Card?

One of the standout features of this card is that it comes with a $0 annual fee, which makes it an attractive option for small businesses looking to maximize their rewards without paying a hefty fee.

Specification: Ink Business Unlimited® Credit Card Review: Earn 1.5% Cash Back and $750 Bonus

|