People on Reddit have talked about their experiences with Capital One Quicksilver so that you may get a clear idea of whether it is a good credit card. This discussion will help you make your choice of getting this card or not.

This Capital One Quicksilver Reddit review looks at the pros and cons of the cashback payments, no signup bonus, rewards bonus, no transaction fees, and the customer service of the card, to see if it’s worth it. You’ll also learn about the minimum credit score needed to get approved for the Quicksilver card. Let us talk about these points to find out if Capital One Quicksilver is a good choice for you.

Let’s dive into these discussions to see if the Capital One Quicksilver is right for you.

Before going straight to the Is Capital One Quicksilver a good credit card – Reddit? Let’s first review it with the latest updates from the official website about its perks and benefits.

Table of Contents

Capital One Quicksilver Card – Capital One Verdict

Here’s what Capital One officially says about the card:

Capital One Quicksilver is a cashback reward credit card. Here’s a quick breakdown:

Cashback Rewards

- You can get 1.5% cash back on everything you buy, and there’s no cap on how much you can earn.

- The card doesn’t cost anything every year, so you don’t have to pay an annual fee to have it.

- Cashback rewards are automatically credited to your account.

Card Benefits

- There is no annual fee.

- You won’t be charged any foreign transaction fees when you use the card outside the United States.

- Includes fraud coverage and security features

- Offers contactless payments to the cardholders

- Contains extended warranty and purchase protection

- Your purchases are protected for 120 days if they get damaged or stolen. The warranty on eligible items is doubled up to 1 extra year.

- 0% Intro APR for the first 15 months, you get 0% interest on new purchases. After that, the regular APR will be between 16.24% – 26.24%.

- You can enjoy Contactless Payments with this card. Just tap your card and pay at compatible terminals.

- You can check your credit score through the Capital One app or website.

- You can manage your account, track your spending, and make payments online through the mobile app.

Eligibility and Application Process

- Available to individuals with good to excellent credit (credit score of 700 or higher)

- Application can be submitted online or by phone

We have already written a comprehensive review of the Capital One Quicksilver Card you can get further details like pros and cons and other fees and rewards etc.

This is what Capital One says about its Quicksilver credit card. Now, let’s move ahead and find out Reddit user’s opinions about this card so that you may have a clear idea when comparing it with official information with the real-world Reddit users are experiencing every day.

Is Capital One Quicksilver A Good Credit Card? Reddit

The Capital One Quicksilver credit card is generally well-regarded on Reddit for its simplicity and straightforward cashback rewards, but the website has some mixed reviews.

Positive Users Reviews

Here’s a list of benefits with positive comments on a subreddit, r/CreditCards by the Reddit community members, they found by getting a Capital One Quicksilver credit card.

1. Cashback Rewards

A Redditor commented (Reddit) that the card offers 1.5% cashback on all purchases, which is appreciated for its simplicity and ease of use.

Here’s another Redditor (Reddit), who is not a big fan of the Quicksilver card because he earns less cash back (1.5%) than the Wells Fargo Active Cash card (2%). However, Quicksilver doesn’t charge a fee for using it in other countries outside the U.S., while Active Cash imposes a 3% foreign transaction fee for each transaction in U.S. dollars.

Both cards are free to have, so the author thinks the Active Cash is the better choice because it earns more cash back.

2. No Foreign Transaction Fees

A Redditor “snow_boy” highlighted a standout feature (Reddit), which is the absence of foreign transaction fees, making it a good option for international travel.

3. No Annual Fee

Users do not pay any additional yearly fees (Reddit).

4. Customer Service

Many users reported great customer service experiences with Capital One (Reddit).

Negative Users Reviews

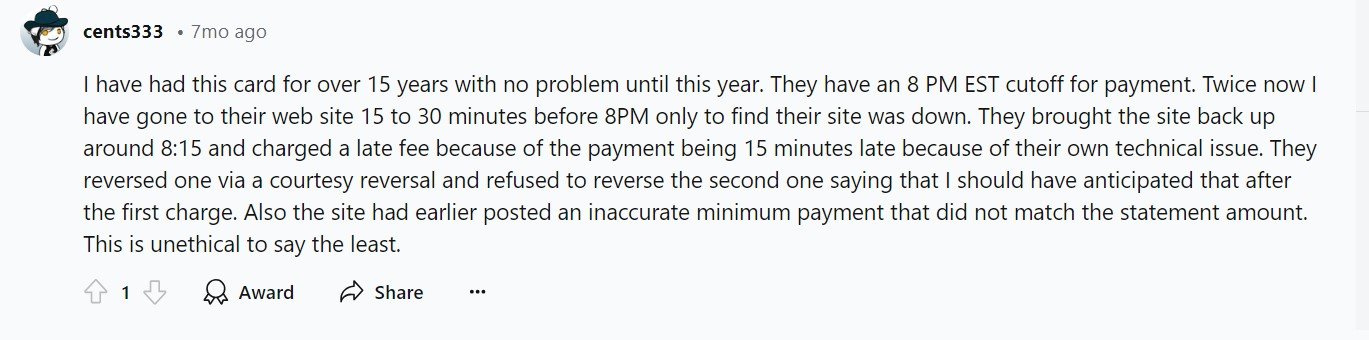

1. Technical Issues and Late Fees

Some Reddit users have raised issues with the bank’s official website being down at crucial times, such as when trying to make a payment, which caused late fees (Reddit).

2. Limited Perks

The card provides a few premium perks and discounts, but these are not very useless (Reddit).

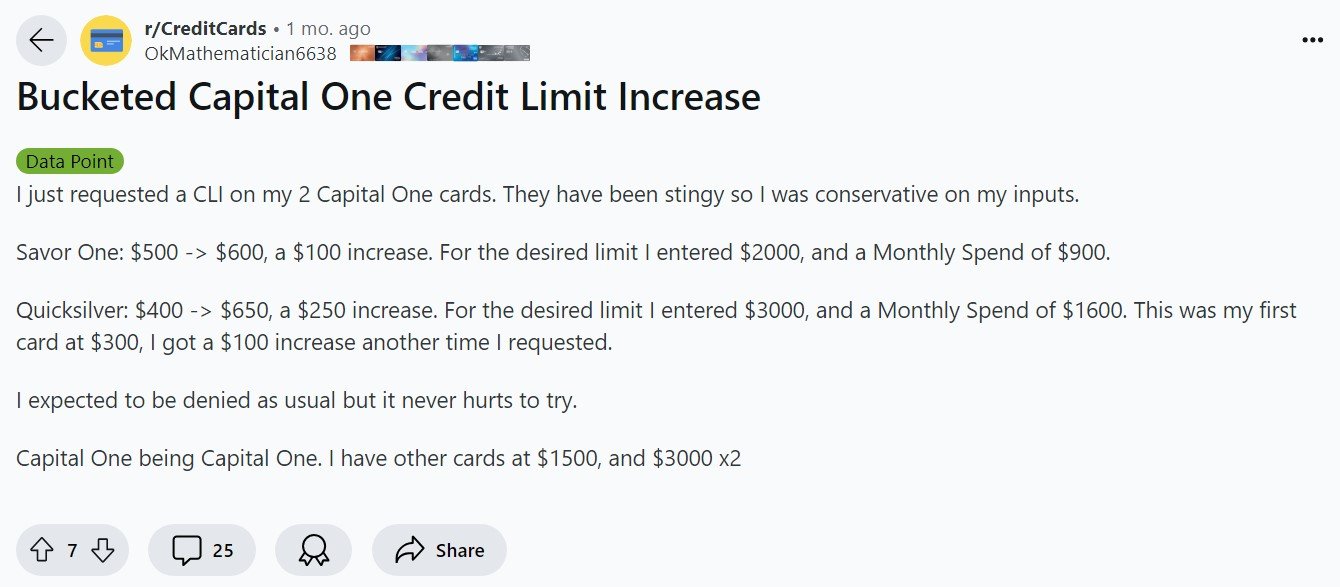

3. Credit Limit Increases

Some users reported, that they may not be able to get their credit limit increased for up to 6 months, which is not good (Reddit).

Overall, Redditors think that the Capital One Quicksilver card is a good choice for people who want a simple cashback card with no yearly fee and no fees for using it outside the United States. However, the benefits are uninteresting and the website might have server-down problems

Who is the Card For?

This credit card is easy to use and earns you cash back on all your purchases. It’s great for people who don’t want to deal with complicated rewards programs. The card has no annual fee, but you might need a very good credit score to get the best benefits.

However, the Quicksilver Cash Rewards Credit Card from Capital One has been designed for users that fit the following profile:

Requirement for Credit Score

Individuals with good to outstanding credit scores, typically 700 or higher are eligible for this card.

Want Flat Cashback Rewards

The card is a good option for those who prefer simple cashback incentives without keeping track of bonus categories. It’s simple to get cash back on regular purchases thanks to the 1.5% flat rewards rate on all purchases.

Wish to Avoid Annual Fees

Because there is no annual fee for Quicksilver, it is an affordable choice for individuals who wish to maximize their benefits without incurring any yearly fees.

Requiring Travel Advantages

There are no foreign transaction fees, which makes Quicksilver a good choice for those who frequently travel abroad and make purchases outside the U.S.

Preference for Simplicity

Suitable to those who like a straightforward rewards program.

Want to Maintain a Healthy Financial Profile

For customers looking to pay interest-free for larger purchases for the first 15 months, and the 0% introductory APR on purchases.

Overall, customers with good credit who are looking for a simple, zero annual fee, cash back card for their regular shopping, and rare travel requirements may choose the Capital One Quicksilver.

Where the Card Doesn’t Measure Up

The Quicksilver card might not be the best fit for a cash-back card with bonus rewards for groceries or restaurants. While it gives you 1.5% cash back on everything you buy, some cards offer higher cashback rates for specific categories you spend on. This could mean more money back in your pocket!

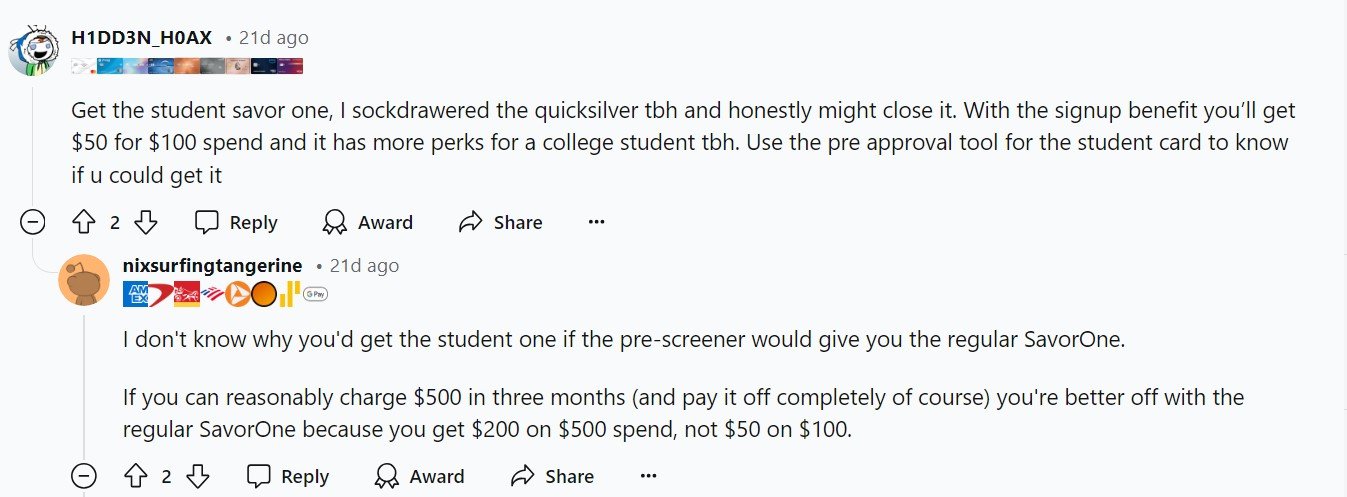

If you also have fair credit, this card might not be ideal you won’t get a sign-up bonus or a lower introductory interest rate with the Quicksilver for good credit. There are other cards, like the Citi Double Cash Card and Capital One SavorOne Cash Rewards Credit Card that offer both a bonus and a lower introductory rate even with fair credit.

FAQs: Is Capital One Quicksilver A Good Credit Card? Reddit

Is it hard to get approved for the Quicksilver card?

A: To qualify for Quicksilver credit cards you need to maintain a Good to Excellent (690 or higher) credit score. Otherwise, getting its approval seems very hard.

What's the credit limit for the Quicksilver card?

The spending limit, also called credit limit, for the Quicksilver One card can vary depending on your credit history and finances. Generally, it falls between $300 and $5,000.

If you need a higher limit, you need to maintain a good credit score and a lower credit score can lead to a lower credit limit.

However, Capital One will automatically review your account for a credit limit boost after 6 months against on-time payments.

You can also request a credit limit increase yourself online, through the Capital One mobile app, or by calling the number on the back of your card.

What kind of card is the Quicksilver One card?

It’s a cashback reward credit card! You earn 1.5% cashback on everything you buy, every time you use the card. Further, there are no foreign transaction fees or annual fees.

What's the difference between Quicksilver and Quicksilver One?

The Quicksilver card is for people with good or excellent credit, and it might come with a welcome bonus. The Quicksilver One card is easier to get approved for even if your credit isn’t perfect, but it doesn’t have a bonus. Both cards give you 1.5% cash back, but other perks might be different depending on the card.