According to Apple, there are 12 million Apple Card Users across the world who have earned $1 Billion cash rewards in their spending, and the number is increasing. But, you are new to this and feeling restricted by your Apple Card limit? Or do you think it would be helpful to raise your spending limit on your Apple Card? Maybe you’ve been using it responsibly and want some more breathing room. The good news is that requesting a credit limit increase is a simple process!

Let’s walk through the steps on how to ask for a higher credit limit on your Apple Card using your iPhone and iPad.

But before jumping to a higher limit increment, let’s find out:

Table of Contents

How You Can View Your Credit Limit And Credit Details Through Your Apple Card?

Using your iPhone:

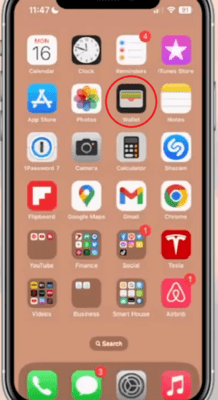

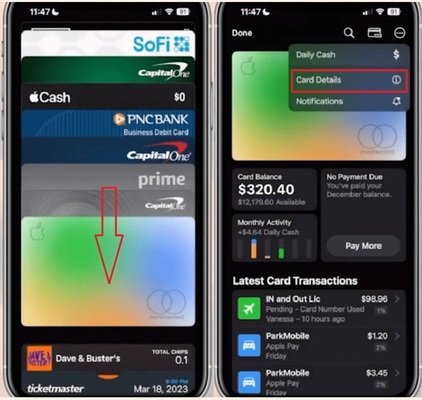

- Go to the Wallet app and press the Apple Card button.

- Select the “More” button and then Card Details.

- Scroll to “Credit Details” to see your account Credit Limit, Credit Available, and APR.

On your iPad:

- Open the Settings app.

- Swipe down to Wallet and Apple Pay.

- Apple Card tap, then tap the Info tab.

- On this side, you can see your Card Balance, Credit Limit, Available Credit, and APR.

Now, let’s move to:

How to Request a Credit Limit Increase on Your Apple Card?

Using iPhone:

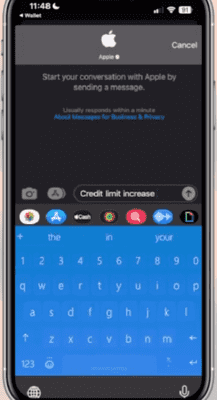

Follow these steps to submit your request:

- Open the Apple Wallet app on your iPhone.

- Tap on your Apple Card to access the card details.

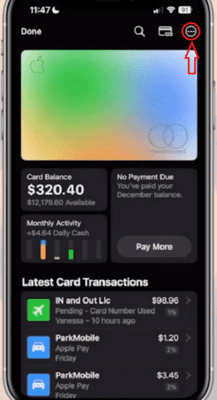

- Scroll down and tap on the “” button.

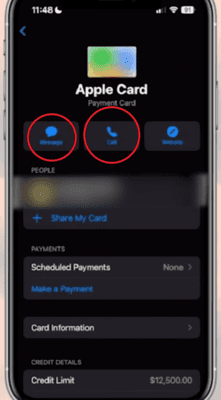

- Select “Message” to initiate a chat with an Apple Card Specialist.

- During the chat, express your interest in increasing your credit limit.

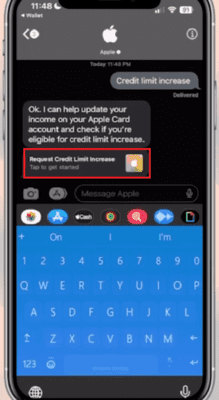

- You’ll receive a link about “Request Credit Limit Increase”

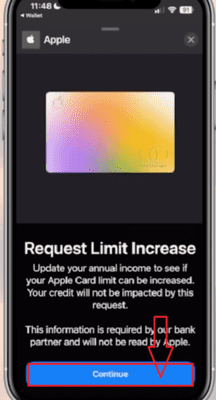

- Open the link in a new tab and tap on the “Continue button”

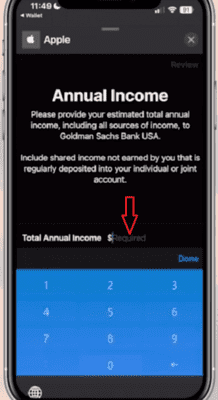

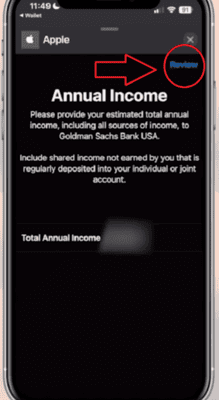

- Provide any necessary documents or information when requested (usually enter your annual income).

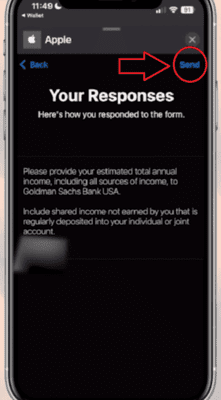

- Tap the Send Button from the upper right corner.

- Tap the “Review Button”, Apple Card Specialist will review your request and may ask for additional information if needed.

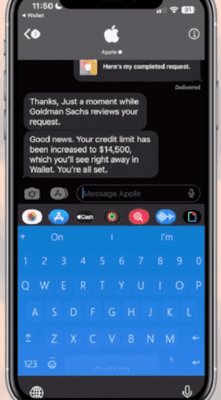

- Once the review is complete, you will receive a response regarding the status of your request.

How to Request a Credit Limit Increase on Your Apple Card?

Using iPad:

- Open the Settings app, then scroll down, and tap on Wallet & Apple Pay.

- Tap the Apple Card and then hit the Info tab.

- You can do this by tapping the Message button.

- Type the message that you want to send about the credit limit increase and then tap the Send button.

The folks at Apple Card (Goldman Sachs) will consider two things when deciding if you can get a higher limit:

- How you’ve been paying your Apple Card bill on time?

- Your overall credit history.

In general, it’s a good idea to wait at least 6 months of using your Apple Card before asking for a limit increase. This gives them time to see your responsible payment habits.

Note*: It’s important to note that Apple Card may perform a soft credit inquiry to evaluate your eligibility for a credit limit increase. This inquiry does not impact your credit score and is merely used for internal assessment. Please be patient and allow some time for the review process to be completed.

How Do You Qualify for an Apple Card Credit Limit Increase?

You want to spend more time using your Apple Card but feel frustrated by your current credit limit. You might be eligible for an increase! Let’s explore what makes Apple more likely to give you a higher spending limit.

Getting a higher spending limit on your Apple Card is like getting the card approved the first time.

Just as with most other credit cards, the Apple Card (issued by Goldman Sachs) would want to ensure that you can handle what you owe. This means they will check your credit report, which is a number that reflects how good you are at paying debts.

The higher you score, the higher your chance of being accepted. They will take into account your income and how much debt you already have compared with what you earn (debt-to-income ratio or DTI). The lower your DTI, the more chances you have to be granted credit.

But here’s the twist: In addition, Apple Card also takes a close look at how you have been using your Apple Card as well. In other words, this refers to paying your bills on time and keeping your overall spending low as compared to your limit.

If you’ve demonstrated a track record of responsible credit utilization for at least 6 months, you are in a position to request a credit limit increase. Also, be prepared that they might not respond to your request immediately after you apply for it.

The Importance of Credit Limits Increases

Having a higher credit limit on your Apple Card may substantially change both your purchasing power and financial flexibility. When the credit limit is added, you can indulge in the things you love, as you won’t exceed the available credit. It also helps in enhancing your credit utilization ratio, a vital element affecting your credit score.

Having a higher credit limit is a positive indicator for lenders because it shows that you are trusted to handle larger amounts of credit without getting into debt. This could lead to easier loan agreements, lower interest rates, and having financial institutions trust you more. Awareness of credit limit increases helps you manage your credit smartly and realize your financial goals.

Tips to Increase Your Chances of Getting Approved

While there are no guarantees when it comes to credit limit increase requests, there are several strategies you can employ to increase your chances of approval. Here are some tips to consider:

- Make sure you’ve had your Apple Card for at least 6 months before asking for a limit increase.

- It’s best to pay your bills on time and keep your credit utilization rate low (not using up too much of your credit limit).

- You can request another increase after 6 months from your previous request.

Apple will review your request and send you a response through the message thread. Remember, being a responsible cardholder goes a long way in getting your request approved!

What Should You Do If Your Credit Limit Increase Request is Denied?

If your request for an increase in credit limit requests on your Apple Card, has been rejected, please don’t be depressed. There are still some actions that can be taken that will give you a better chance in the future.

Begin the procedure by getting in touch with the Apple Card support team to figure out the reasons for the rejection. Knowing exactly which of the factors resulted in the rejection of your offer is what you need to work on and increases your chances of success the following time.

Utilize this opportunity to go through your credit report and score, identifying any insufficiencies and incorrect accounts. Disagree with any errors and work to reduce areas of concern like default payments or high credit utilization.

You can accomplish these goals and demonstrate your creditworthiness through responsible credit utilization by increasing your chances for a future credit limit increase.

Alternatives to Apple Card with More Perks

Here are some credit cards like the Apple Card, especially for the consumers who spend a lot more money. These cards offer bigger rewards, more benefits, and higher credit limits. Although they cost more per year (as an annual fee) than the Apple Card, but you get extra perks.

Here are the alternatives to consider:

1. Chase Sapphire Reserve

- Annual Fee: $550

- Credit Limit: Up to $100,000

2. American Express Platinum Card

- Annual Fee: $695

- Credit Limit: Up to $100,000

See Full Review

3. Citi Prestige Card

- Annual Fee: $495

- Credit Limit: Up to $100,000

4. Bank of America Premium Rewards Credit Card

- Annual Fee: $95

- Credit Limit: Up to $75,000

5. Wells Fargo Propel World American Express Card

- Annual Fee: $0

- Credit Limit: Up to $50,000

Remember, the higher the annual fee, usually the more rewards and benefits you get. Think about how much you spend and what perks are most important to you before choosing a card other than Apple Card.

Conclusion

In conclusion, with a strategic approach and responsible credit management, a credit limit increase on your Apple Card is within reach. By understanding the advantages, considering the factors involved, and following the outlined steps, you can effectively navigate the process and unlock greater financial flexibility.

Remember, maintaining good financial habits, regularly monitoring your credit report, and exercising patience are key throughout this journey. With a higher credit limit, you’ll gain more breathing room for larger purchases and unexpected expenses, as well as build a stronger credit history. Empower yourself financially today by increasing your Apple Card credit limit and enjoying the freedom of greater buying power.

FAQs: How to Request Credit Limit Increase Apple Card?

How do I request a credit limit increase for my Apple Card?

You can request a credit limit increase directly through the Apple Wallet app on your iPhone. Here’s how:

- Open the Wallet app.

- Tap on your Apple Card.

- Scroll down and tap the “…” button.

- Select “Message” to initiate a chat with an Apple Card Specialist.

- Express your interest in increasing your credit limit and provide any necessary documents or information when requested.

Does requesting a credit limit increase hurt my credit score?

Apple may perform a soft credit inquiry when reviewing your request. Soft inquiries do not impact your credit score.

How long will it take to find out if my request is approved?

The approval process can vary, but you should receive a response from Apple within a short period (usually a few minutes) after submitting your request.

How can I improve my chances of getting a credit limit increase?

Here are some tips to increase your chances of approval:

- Maintain a good payment history with your Apple Card and other credit accounts.

- Keep your credit utilization ratio low (ideally below 30%).

- Demonstrate a stable income and employment history.

- Avoid making multiple credit limit increase requests within a short period.

By following these tips and managing your credit responsibly, you can increase your chances of getting approved for a credit limit increase on your Apple Card.