How to Use PayPal Credit in Store Without a Card: A Comprehensive Guide

PayPal Credit has become a popular way to make purchases online, offering the convenience of paying over time with flexible payment plans. However, many consumers may not know that they can also use PayPal Credit for in-store purchases without needing a physical card. This article will explain how to use PayPal Credit in-store, without a card, and provide all the essential details you need to shop with this convenient payment method in physical retail stores.

Table of Contents

What is PayPal Credit?

Before diving into how to use PayPal Credit in-store, let’s first understand what PayPal Credit is. PayPal Credit is a digital line of credit that allows you to make purchases on various online stores that accept PayPal. It functions like a virtual credit card, with the flexibility of spreading out payments over time and often with promotional 0% interest on qualifying purchases.

Unlike traditional credit cards, PayPal Credit doesn’t require a physical card, making it an excellent option for people who want the convenience of credit without carrying an extra card. The main benefit of PayPal Credit is its ability to break up large purchases into manageable payments, usually offering 0% interest for a set period, such as four months for purchases over a certain threshold.

Can You Use PayPal Credit In-Stores?

Yes, you can use PayPal Credit in stores, but it requires a few extra steps since there’s no physical card to swipe. PayPal has partnered with several retailers and payment systems to allow you to make in-store purchases using your PayPal Credit Line, which can be accessed via the PayPal mobile app or third-party services like Curve.

While you cannot directly use PayPal Credit in every store, there are growing numbers of retailers and service providers that accept PayPal QR code payments or other digital wallet options that work with PayPal Credit.

How to Setup Use PayPal Credit in Stores Without A Physical Card

PayPal Credit doesn’t offer a physical card, but you can still use it for in-store purchases in several ways:

- PayPal App: The easiest way to use PayPal Credit in stores is through the PayPal mobile app. At checkout, simply select PayPal as your payment method. You will then log into your PayPal account and select PayPal Credit as your payment option.

- QR Codes: Retailers like Walmart and Target now support PayPal Credit payments through a PayPal QR code. To pay with PayPal Credit, just open the PayPal app, choose your payment method, and scan the QR code provided by the cashier. This allows you to use PayPal Credit without needing a physical card.

- Mobile Wallets: PayPal Credit can also be used through mobile wallets like Apple Pay and Google Pay. Simply link your PayPal Credit account to your mobile wallet, and you can use it just like a regular credit card at any store that accepts these mobile payment methods.

- PayPal Credit-Linked Debit Cards: Another option is to use a PayPal Credit-Linked debit card. This card works just like any other debit or credit card and can be used at any store that accepts debit or credit card payments.

Benefits of Using PayPal Credit In-Stores

- Flexibility in Payments: One of the main advantages of PayPal Credit is that it allows you to spread out payments over time. Whether you’re shopping for small or large items, you can manage your payments and avoid paying the full amount upfront.

- Interest-Free Periods: For certain purchases over $99, PayPal offers special financing options with 0% interest for a set period, often 6 months or more, making it easier to manage larger purchases.

- Convenience: PayPal Credit gives you the freedom to shop and pay later at millions of locations worldwide. The ability to pay through your mobile wallet or via QR codes makes in-store payments even more convenient.

- Security and Buyer Protection: Like all PayPal transactions, purchases made with PayPal Credit are covered by PayPal’s buyer protection, which can give you added peace of mind when shopping in-store.

- No Physical Card Required: If you prefer not to carry credit cards, PayPal Credit provides a digital line of credit that you can use without needing a physical card. The app and mobile wallet integrations like Curve make it possible to pay just using your phone.

How to Check if a Store Accepts PayPal Credit

While many retailers accept PayPal Credit in-store, it’s always a good idea to check with individual stores to confirm that they accept PayPal Credit before heading out. Retailers may update their payment options periodically, and acceptance can vary by location. You can usually find this information on the retailer’s website or by asking a cashier directly at the store.

Expanding Acceptance of PayPal Credit In-Stores

The list of stores accepting PayPal Credit in-store is growing, and many small businesses are also starting to integrate it as a payment option. The rise of mobile wallets and QR codes has made it easier for PayPal Credit to be accepted at more locations, which means you can use it at an increasing number of physical stores.

Tips for Using PayPal Credit In-Store

Here are some helpful tips to make the most of your PayPal credit when shopping in-store:

- Check Participating Stores: Not all stores accept PayPal Credit in-store. Always check if the store supports PayPal QR code payments or mobile wallet integrations.

- Enable Your PayPal PIN: Set up a secure PIN within the PayPal app to ensure that your transactions are safe and quick.

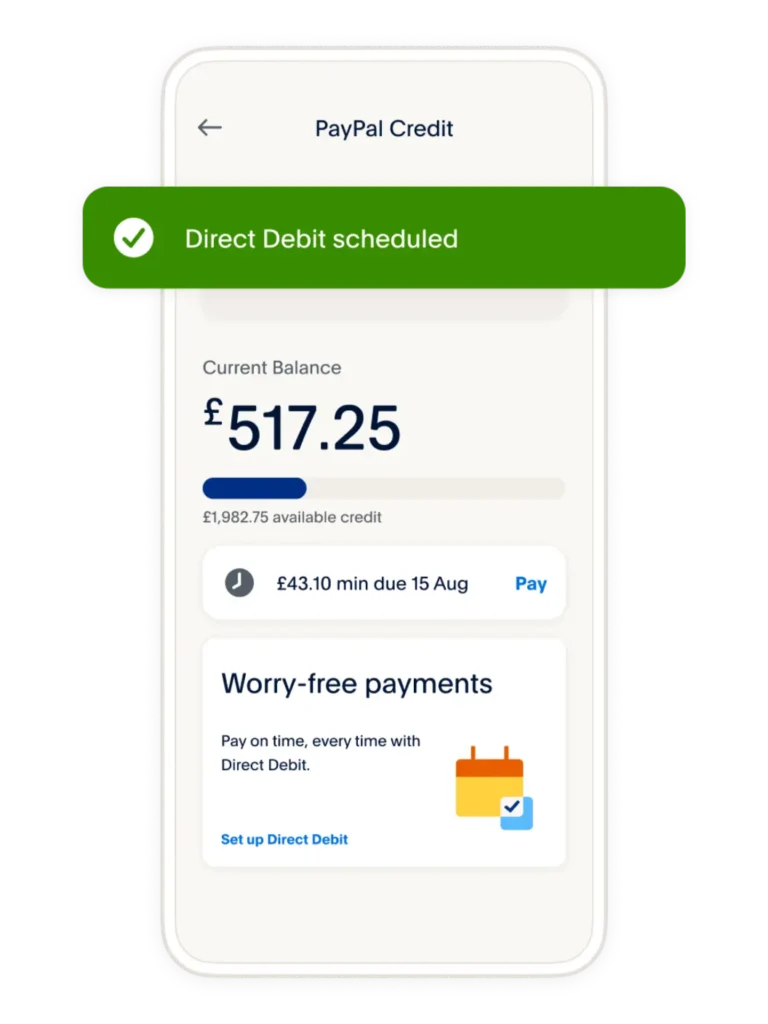

- Monitor Your Balance: Keep track of your PayPal Credit balance through the app to ensure you don’t exceed your credit line.

- Take Advantage of Promotions: PayPal Credit often offers 0% interest for several months on large purchases. Be sure to take advantage of these offers to avoid interest charges.

Where Can You Use PayPal Credit In-Stores?

PayPal Credit is a convenient way to pay for purchases over time, but many people wonder if they can use it for in-store shopping. While PayPal Credit is more commonly associated with online purchases, there are many physical stores where you can use it as well.

Let’s take a closer look at where you can use PayPal Credit in stores, how to do it, and the benefits it offers.

Popular Retailers That Accept PayPal Credit In-Stores

PayPal has partnered with a number of well-known retailers and payment platforms to enable in-store payments using PayPal Credit. While it’s not available at every store, many major retailers have embraced this payment option, and it continues to grow. Here are some popular stores where you can use PayPal Credit in physical locations:

- Best Buy: This major electronics retailer allows you to pay using PayPal Credit when shopping in-store.

- Home Depot: Use PayPal Credit at Home Depot for purchasing home improvement supplies and tools.

- CVS: Pay for your pharmacy items or other purchases at CVS using PayPal Credit.

- IKEA: Pay for your furniture and home goods at IKEA with PayPal Credit, making it easier to manage larger purchases over time.

- Walmart (via PayPal QR Code): Walmart now accepts PayPal Credit in-store via a PayPal QR code, allowing you to pay using your PayPal account linked to PayPal Credit.

- Target (via PayPal QR Code): Similar to Walmart, you can use PayPal Credit at Target by scanning a PayPal QR code at checkout.

- Small and Local Stores (via Mobile Wallet Integration): Many local stores are now accepting PayPal Credit through integrations with mobile wallet services like Apple Pay and Google Pay.

These stores are just a few examples, but the list of physical locations where PayPal Credit can be used is steadily growing as more retailers adopt PayPal as a payment method.

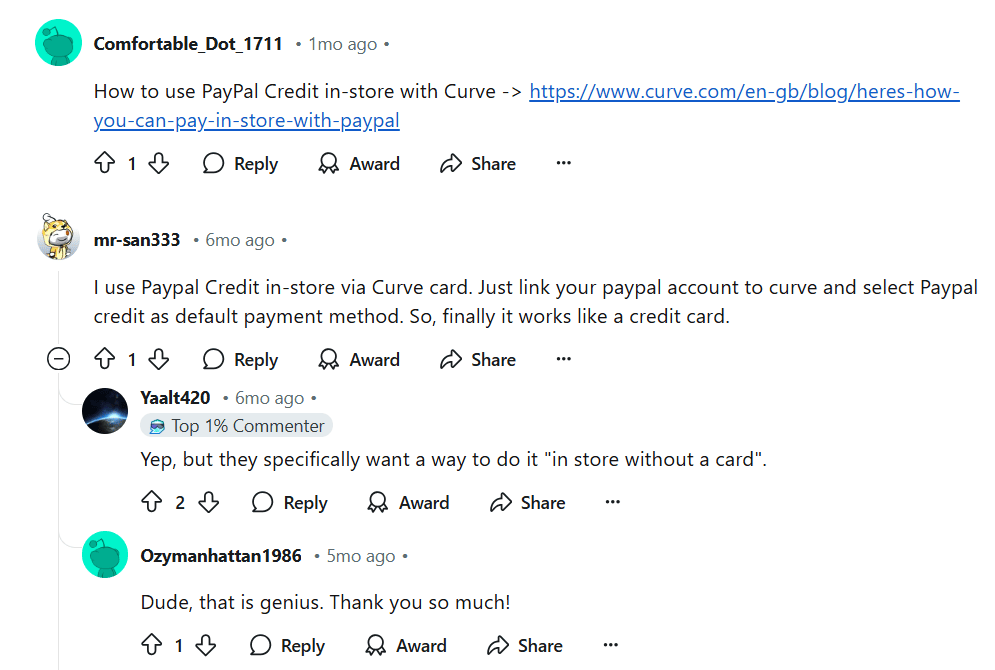

Steps to Use PayPal Credit with the Curve App

For additional flexibility, PayPal has partnered with Curve, a mobile wallet that allows you to use PayPal Credit at virtually any store that accepts card payments. Curve essentially acts as a bridge between your PayPal account and in-store payments.

Here’s what Redditors says about using PayPal Credit with Curve App:

Here’s how you can set it up:

Download the Curve App

Start by downloading the Curve app from the App Store (iOS) or Google Play (Android).

Order or Use a Virtual Curve Card

You can order a physical Curve card or begin using a virtual card right away for online and in-store purchases.

Link PayPal to Curve

Once the app is set up, link your PayPal account to Curve. This step will enable you to use your PayPal Credit balance at any location that accepts Curve as a payment method.

Add Curve to Mobile Wallets

After linking your PayPal account to Curve, you can add your Curve card to your mobile wallet (Apple Pay, Google Pay, etc.). This will allow you to use PayPal Credit in-store seamlessly, just like any credit card.

Use PayPal Credit in Stores

When you make in-store purchases, simply select Curve as your payment method on your phone’s wallet and choose PayPal Credit as your payment source. The transaction will be processed directly through your PayPal credit line.

Conclusion

PayPal Credit offers a convenient and flexible way to shop in-store without needing a physical card. Whether you’re using it through the PayPal app, Curve, or QR code payments, you can easily make purchases and manage your payments over time. By following the simple steps outlined in this guide, you can start using PayPal Credit for your next in-store purchase and enjoy all the benefits of this digital credit option.

Here are a few other recommendations you might be interested in:

FAQs: How to Use Paypal Credit In-Store without Card?

Is PayPal Credit secure for in-store purchases?

Yes, PayPal Credit is secure for in-store purchases. PayPal uses advanced encryption and fraud prevention technologies to protect your financial information. Additionally, PayPal offers buyer protection, which can help resolve any issues with your purchase.

Are there any eligibility requirements for PayPal Credit?

Yes, there are eligibility requirements for PayPal Credit. These requirements may include a minimum credit score, income verification, and a valid PayPal account. PayPal will assess your creditworthiness during the application process.

Can I use PayPal Credit for online purchases as well?

Yes, PayPal Credit can be used for both in-store and online purchases. It offers a seamless payment option across various shopping channels.

What happens if I don't pay my PayPal Credit balance in full?

Interest charges may apply if you don’t pay your PayPal Credit balance in full within the specified period. It’s important to carefully review the terms and conditions of your PayPal Credit account to understand the repayment terms.

Can I use PayPal Credit internationally?

Yes, PayPal Credit can be used internationally. However, acceptance may vary by country and individual stores. It’s always a good idea to check with the retailer before making a purchase abroad.