2025 Capital One SavorOne Student Credit Card Review – Is It Worth It?

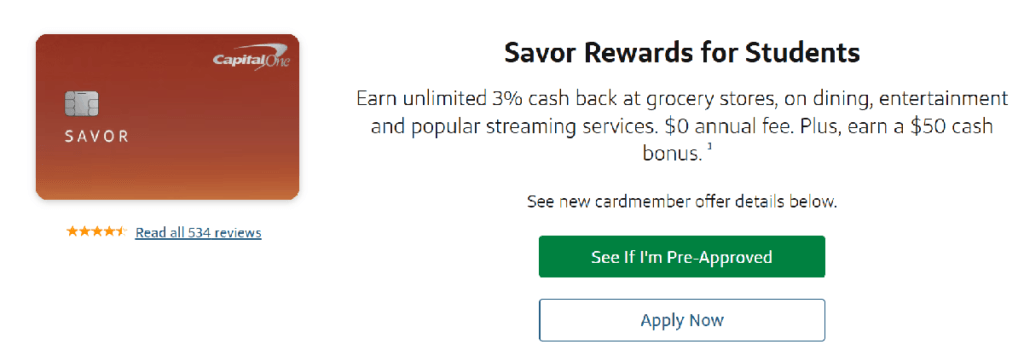

Capital One SavorOne Student Cash Rewards Credit Card is an excellent option for student looking for 1% – 10% cashback on entertainment, steaming services and groceries with $50 intro bonus. SavorOne Student Credit Card has no annual fee, no foreign transaction fee, and Fair to Good (580 – 739) credit score needed.

Table of Contents

Capital One SavorOne Student Cash Rewards Credit Card Review

The Capital One SavorOne Student Cash Rewards Credit Card has quickly become a favorite among students looking for a credit card that rewards their everyday spending. With its straightforward rewards structure, generous cashback categories, and low fees, this card is designed to help students build their credit while earning rewards for regular purchases. In this detailed review, we will explore the features, pros, and cons of the Capital One SavorOne Student Cash Rewards Credit Card and how it compares to other student credit cards on the market in 2025.

What is the Capital One SavorOne Student Cash Rewards Credit Card?

The Capital One SavorOne Student Cash Rewards Credit Card is a no-annual-fee credit card for college students looking to earn cash back on their everyday spending. The card offers attractive bonus categories and a straightforward rewards system that makes it easy for students to earn cash back without worrying about activation or spending caps. Additionally, it comes with solid perks like travel and purchase protection, making it an excellent choice for students who want to get started on the road to good credit.

Features of the Capital One SavorOne Student Cash Rewards Credit Card

Image Credit: https://www.capitalone.com/credit-cards/savor-student/

Rewards Rate:

- 3% cash back on dining, entertainment, popular streaming services, and groceries (excluding superstores like Walmart® and Target®).

- 5% cash back on hotels and rental cars booked through Capital One Travel.

- 8% cash back on purchases made through Capital One Entertainment.

- 1% cash back on all other purchases.

Intro Offer:

- Earn a $50 one-time cash bonus after spending $100 on purchases within the first three months from account opening.

Annual Fee:

- $0

APR (Interest Rates):

- Purchase APR: 19.49% – 29.49% (Variable)

- Cash Advance APR: 19.49% – 29.49% (Variable)

- Balance Transfer APR: 19.49% – 29.49% (Variable)

- Foreign Transaction Fee: $0

Other Benefits:

The Capital One SavorOne Student Cash Rewards Credit Card is packed with benefits that cater to college students. From earning cash back to secure travel options, here are the key features:

Cash Back Rewards

Earn 3% back on dining, 2% on groceries, and 1% on all other purchases. This rewards program helps students save on everyday expenses.

No Foreign Transaction Fees

There are no extra charges for international purchases. It’s perfect for students traveling abroad or studying in another country.

Complimentary Concierge Service

Get 24/7 help with dining, travel, and entertainment planning. The concierge service makes life easier for busy students.

Extended Warranty

Eligible purchases come with an extended warranty, offering added protection for items bought with the card.

Price protection

That reimburses a price drop within 120 days of purchase.

CreditWise® Reporting

Customers will receive free credit monitoring and alerts.

24/7 Travel Assistance

If you lose your card while traveling, get an emergency replacement or cash advance. Help is available anytime, anywhere.

Travel Accident Insurance

Automatically covered when you use the card for travel purchases. This insurance provides peace of mind during your trips.

Instant Purchase Notifications

Receive real-time alerts for each new purchase. This feature helps students track their spending and manage finances easily.

Capital One Shopping Tool

Save money with an automatic coupon code application when shopping online. It’s a simple way to get the best deals.

Use Rewards for Amazon & PayPal

Redeem cash-back rewards for Amazon purchases or use PayPal at millions of stores. This flexibility is great for students.

Account Management Tools

The Capital One app lets you manage payments, track purchases, and check your credit score on the go. Keep your finances organized anytime.

Virtual Assistant

Eno®, Capital One’s virtual assistant, helps manage your account and protect your online purchases.

These features make the Capital One SavorOne Student Credit Card a powerful tool for managing finances while enjoying perks tailored for students.

Interest Rates and Fees: Savor Student Credit Card

One of the benefits of the Capital One SavorOne Student Credit Card is that it has no annual fee. Additionally, there are no foreign transaction fees, making it a great option for students who travel or study abroad.

Here’s the breakdown of the Capital One SavorOne Student Credit Card Fees and interest rates:

- Annual Fee: None.

- Foreign Transaction Fees: None.

- APR for cash advances: 29.49%.

- Balance Transfer Fee: 3% of the amount of each transferred balance.

- Cash Advance Transaction Fee: Either $3 or 3% of the amount of each cash advance, whichever is greater.

- Annual Percentage Rate (APR) on Purchases and Transfers: 19.49%, 29.49% based on your creditworthiness.

- Late Payment/Penalty Fees: Up to $40.

- Introductory APR: No introductory APR on purchases.

- Monthly Maintenance Fee: N/A

- Returned payment fee: $25

See full interest rates and fees

Maximum Credit Limit on the Capital One® SavorOne Student

Savor One Credit Card limit is determined based on several factors, such as creditworthiness, income, and credit history. While Capital One has self-reported credit limits starting from $300 to $750, there are chances of receiving a credit limit higher than $1,000.

However, the minimum credit limit for the SavorOne Capital One Credit Card is $300, making it ideal for students who desire to build or rebuild their credit score. However, you can find tips on how you can increase your credit limit upto $5,000. Overall, the Capital One® SavorOne Student Credit Card limit is designed to enable students to build good credit while enjoying the perks of cashback rewards.

How to Earn Rewards with the Capital One SavorOne Student Card?

One of the most appealing aspects of the Capital One SavorOne Student Cash Rewards Credit Card is its easy-to-understand rewards structure. There are no rotating categories or activation requirements, making it simple for students to maximize their cashback earnings. Here’s a breakdown of how you can earn rewards:

- Dining & Entertainment: Whether it’s dining out at your favorite restaurant or catching a movie, you can earn 3% cash back on these everyday expenses.

- Streaming Services & Grocery Stores: Streaming services like Netflix, Hulu, or Spotify, along with grocery store purchases (excluding superstores like Walmart® and Target®), also earn 3% back.

- Hotels & Rental Cars: Booking through Capital One Travel earns you 5% cash back on hotels and car rentals, which can add up quickly for students traveling during breaks or for business.

- Capital One Entertainment: If you’re purchasing tickets to concerts, sports events, or other entertainment through Capital One Entertainment, you can earn a whopping 8% cashback.

- Other Purchases: All other purchases earn a standard 1% cash back, which is decent but not as competitive as the bonus categories.

Redeeming Rewards

Redeeming rewards with the SavorOne Student Credit Card is simple. Cardholders can redeem their cashback rewards through a statement credit or check, shop on Amazon or PayPal, or get gift cards. You can also set your rewards to be given out when you reach $25, $50, $200, $500, or $1,500 in rewards (or once per year).

How Does the Capital One SavorOne Student Card Compare to Other Student Credit Cards?

The Capital One SavorOne Student Cash Rewards Credit Card stands out due to its impressive bonus categories and rewards rates. However, there are a few other popular student cards worth considering, each with its unique benefits. Let’s compare the SavorOne with other leading student credit cards:

Capital One SavorOne vs. Capital One Quicksilver Student Card

- Rewards Rate: The Capital One SavorOne Student Card offers 3% cash back on dining and entertainment, while the Capital One Quicksilver Student Cash Rewards Credit Card offers a flat 1.5% on all purchases. If you’re spending more on bonus categories like dining and entertainment, the SavorOne is the better option.

- Welcome Bonus: Both cards offer a $50 bonus after spending $100 in the first three months.

- Annual Fee: Both cards have a $0 annual fee, making them cost-effective for students.

Capital One SavorOne vs. Discover it® Student Cash Back

The Discover it® Student Cash Back card is another popular option for students who want to earn cashback. However, it operates differently from the SavorOne card:

- Rewards Rate: Discover offers 5% cash back on rotating categories (up to a quarterly spending limit), while SavorOne offers 3% in consistent categories. This makes the SavorOne easier to manage, as you don’t have to worry about activating categories.

- Intro APR: Discover offers a 0% intro APR for the first six months, while the SavorOne does not. If you plan to make large purchases or need to transfer a balance, Discover might be a better choice.

Who Should Consider the Capital One SavorOne Student Cash Rewards Credit Card?

The Capital One SavorOne Student Cash Rewards Credit Card is ideal for college students who:

- Spend heavily on dining, entertainment, and streaming services.

- Want a simple, no-annual-fee card with valuable rewards?

- They are looking to build their credit with responsible usage.

However, it may not be the best option for students who:

- Need to carry a balance and are concerned about high APRs.

- Want an introductory APR offer for purchases or balance transfers?

- Prefer a simpler, flat-rate rewards structure.

How Do You Apply?

To apply for the Capital One Student Card, you can visit their official website or contact them at their Helpline Center.

Capital One SavorOne Student Credit Card Requirements/Approval Odds

When it comes to the Capital One SavorOne Student Card, the minimum credit score needed for approval is 580 to 739 (FICO Score), which is fair to good or average, or sometimes no credit history is required. However, it’s important to note that your annual income and existing debts will also influence approval odds. If you’re a student with no credit history, there’s a good chance that you’ll be approved for this card. Keep in mind that you must be at least 18 years old to apply.

Some additional points to consider regarding the Capital One SavorOne credit score requirements include:

- This card is meant for newcomers/students with at least fair credit, so if your credit score is below 580, you may want to look into other options.

- Even if your credit score is above 580, there’s no guarantee that you’ll be approved for the Capital One SavorOne Student Card. Your income and debt-to-income ratio will also play a role in the decision.

- If you’re approved for this card, you can enjoy a variety of rewards and benefits, including cash back on dining and entertainment purchases. Plus, there’s no annual fee to worry about.

Overall, the Capital One SavorOne Student Card is a solid option for students who are looking to build their credit. As long as you meet the minimum credit score requirements and have a steady source of income, your approval odds should be good.

Helpline

You can call Capital One at 1-877-383-4802 or at the credit card customer service number (for existing customers only) 1-800-CAPITAL (227-4825). For more information, see their contact options.

Conclusion: Is the Capital One SavorOne Student Cash Rewards Credit Card Worth It in 2025?

In summary, the Capital One SavorOne Student Cash Rewards Credit Card is a great choice for students who want to earn solid cashback rewards on dining, entertainment, and streaming purchases in 2025. With no annual fee, automatic credit line reviews, and valuable travel protection benefits, it provides a strong foundation for building good credit. However, suppose you anticipate carrying a balance or need an intro APR offer. In that case, you may want to explore other student cards like the Bank of America® Customized Cash Rewards Credit Card for Students or the Discover it® Student Cash Back card.

FAQs: Capital One SavorOne Student Cash Rewards Credit Card

What credit score is required for the Capital One SavorOne Student Card?

A fair to good credit score (580-740) is recommended for approval. However, students with limited credit history can still apply.

Can I upgrade my Capital One SavorOne Student Card after graduation?

Yes! After graduation or with an improved credit score, you can contact Capital One to explore upgrade options to the full Capital One Savor card.

Is there an annual fee for the Capital One SavorOne Student Card?

No, this card has no annual fee, making it a cost-effective option for students.

Specification: 2025 Capital One SavorOne Student Credit Card Review – Is It Worth It?

|