5 Reasons the Citi Double Cash Card is a Top Choice for Shoppers

The Citi Double Cash card offers 2% cash back on purchases, 1% cash back when you make a purchase, and an additional 1% cash back when you pay your bill. Enjoy $200 cashback as an intro offer and 0% intro APR for 18 months. It comes with no annual fee.

Table of Contents

Citi Double Cash Card Review

The Citi Double Cash® Card is a cashback credit card that makes it easy to earn rewards. While it may be light on features and doesn’t offer an introductory APR on purchases, its biggest merits lie in its top-tier flat-rate rewards and generous introductory APR offer on balance transfers. With a combined 2% cash back (1% at purchase, 1% when you make payment) and no annual fee, it’s among the best cashback cards.

If you’re looking for a straightforward way to earn cash back, the Citi Double Cash card can be your second credit card. In this comprehensive guide, we’ll review the Citi Double Cash® Card, regarding cashback rewards, and the various benefits of using it in restaurants, supermarkets, and gas stations.

Quick Highlights

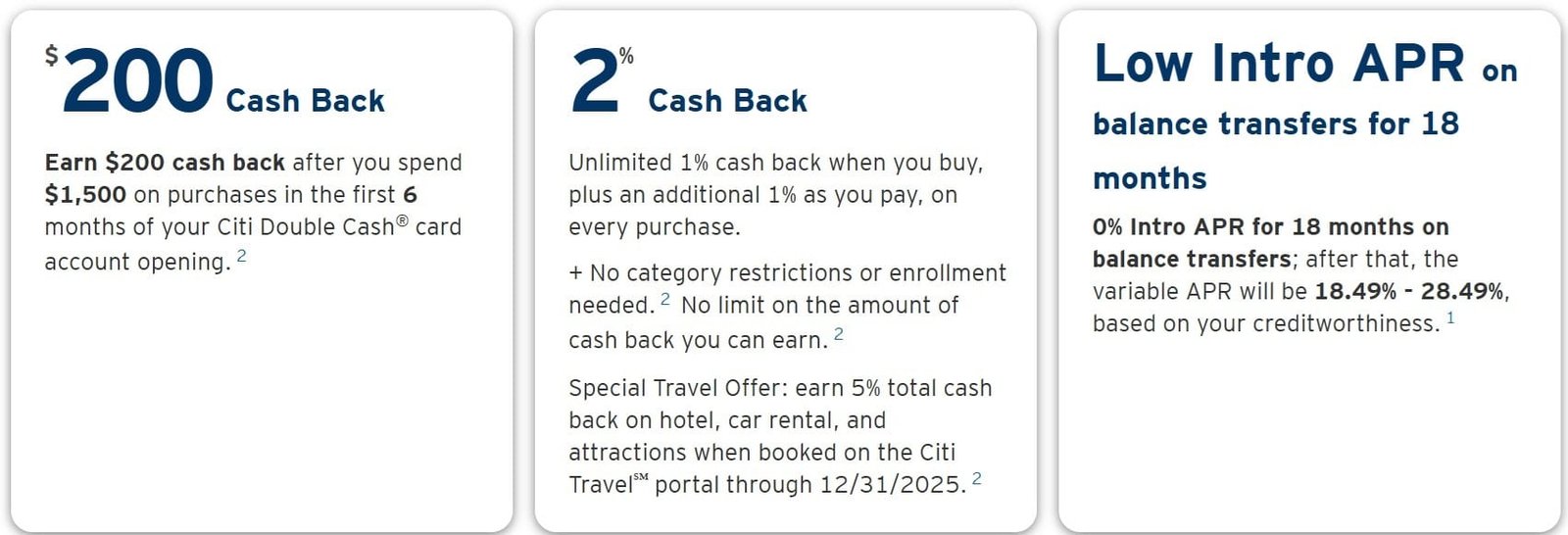

- You’ll receive 2% cashback on all purchases. There are no category restrictions or enrollment requirements.

- You can earn $200 cashback after spending $1500 on purchases in the first six months of getting the card.

- Receive your rewards by direct deposit, check, or statement credit.

- A competitive 0% intro APR on balance transfers for 18 months, although you’ll want to look at the standard variable APR range of 18.49%–28.49% afterward, based on your creditworthiness.

- A convenient 3% for each transaction made in a foreign currency, efficiently filtering out unnecessary international monetary headaches.

Why You Might Want the Citi Double Cash Card

If you need cashback on everything you buy, then the Citi Double Cash Card is worth considering. You get 2% cash back on all purchases, plus a signup bonus of $200 if you spend a bit in the first few months. It even gives you extra cashback on travel! Read on to see how easy it is to earn and use your rewards!

- Welcome Sign-Up Bonus: New cardholders can earn a welcome bonus of $200 cashback (20,000 Thank You Points) after spending $1,500 in purchases within the first 6 months of account opening.

5% Cashback on Travel: Earn 5% cashback on booking flights, hotels, and other travel experiences through Citi ThankYou Travel Center. - 2% Cashback on Purchases: As we have mentioned earlier, you can earn up to 2% cashback on all your purchases. This unique structure awards 1% cash back when you make a purchase and an additional 1% cash back when you pay off the bill.

- No Category Restrictions: You earn the same cash back on everything you buy with the Citi Double Cash® Card. This means you don’t have to worry about remembering which stores earn more cashback each month.

- Unlimited Rewards: There are no caps on how much cashback you can earn, allowing you to maximize your reward potential. The more you spend, the more you earn.

Earning Rewards with the Double Cash Card

The Double Cash Card now earns points called “Citi ThankYou points.” These points can be redeemed for cash back at the same rate you used to earn (1 cent per point, which is like getting 2% cash back).

You can now use your points for more things without converting them first! You can get cash back as a direct deposit, statement credit, or even a check. There’s no minimum amount you need to have saved up to redeem.

Want more options? You can also use your points to:

- Book travel: flights, hotels, cruises, and rental cars.

- Shop at certain stores (you’ll need to sign up first).

- Donate to charity.

- Make student loan or mortgage payments (but keep in mind the value of your points might be lower).

Important Note: Using your points for things other than cashback might give you fewer points for your money. For instance, using points for Amazon purchases only gets you 0.8 cents per point.

Travel tip: If you travel a lot, you might want to consider getting a different Citi card, like the Citi Premier Card (no longer available). This card lets you transfer your points to many airlines and hotels, which can sometimes give you more value for your points.

Overall: The Double Cash Card is a good option for people who want a simple cash-back card with some flexibility. But if you travel often, you might want to consider another card to get the most out of your points.

Citi Double Cash Card Rates and Fees

APR Rates

- Regular APR: 18.49%–28.49% (variable) based on your creditworthiness.

- Intro APR: 0% intro APR on balance transfers for 18 months, then the ongoing APR is 18.49%–28.49% (variable).

- APR for Balance Transfer: Enjoy a 0% introductory APR for 18 months on balance transfers, but only if you complete the transfers within the first four months of opening your account.

- Varibale APR for Cash Advance: 29.74%

- APR For City Flex Plan: 18.49%-28.49%

- Penalty APR: up to 29.29% applies

- Minimum Interest Charge: Interest charges will be at least $0.50 cents.

- Plan Fee: A monthly fee of up to 1.72% may apply to transactions you move to a Citi Flex Plan.

Fees

- Annual Fee: $0

- Balance Transfer Fee: Intro fee of 3% of each transfer ($5 minimum) completed within the first four months of account opening. After that, 5% of each transfer ($5 minimum).

- Cash Advance Fee: 5% of each cash advance; $10 minimum.

- Foreign Transaction Fee: 3%

- Late Payment: Up to 41$

- Returned Payment: Up to 41$

Features and Benefits

Here’s the breakdown of Citi Double Cash® Credit Card features and benefits:

1. 0% intro APR on Balance Transfers

For a limited time, enjoy a 0% introductory APR on balance transfers for 18 months (followed by a variable APR of 19.24%–29.24%). This can help consolidate high-interest debt and save on interest charges.

2. Digital Wallet Compatibility

In our digital age, flexibility in how you pay is crucial. The Citi Double Cash Card integrates seamlessly with digital wallets, affording you the confidence to shop online, within apps, and in stores across millions of locations.

The integration not only streamlines your checkout process but also continues to protect the great benefits associated with your card.

3. 24-Hour Fraud Protection

Citi’s proactive fraud protection service is designed to detect and alert you of any unusual activity on your account, day or night, promising peace of mind.

4. Identity Theft Protection

Citi partners with Mastercard to offer an identity theft protection program. This service monitors your personal information and alerts you to any suspicious activity, enabling you to enroll for free and ensuring protection begins immediately.

5. $0 Liability on Unauthorized Charges

An essential feature for any credit card user is the assurance that they won’t be responsible for unauthorized charges. The Citi Double Cash Card guarantees $0 liability on unauthorized charges, providing details and further peace of mind at cardbenefits.citi.com.

6. Citi Entertainment

Not just about spending, the Citi Double Cash Card is also about experiences. Cardholders get special access to purchase tickets to a plethora of events. Whether it’s presale tickets or exclusive experiences, Citi Entertainment ensures that cardholders can make the most of the year’s most-awaited concerts, sports events, dining experiences, and more.

The Citi Double Cash Card is designed not just as a financial tool but as a lifestyle enhancer for those who are meticulous about where their money goes—whether they are making purchases or enjoying the cashback they’ve earned.

The range of benefits, coupled with strong customer support, contactless payment options, and significant security features, makes the Citi Double Cash Card an attractive option for credit builders, cashback lovers, and the financially savvy alike.

7. Global Acceptance with Security

The Citi Double Cash Card is accepted almost anywhere in the world thanks to Mastercard®, so you can use it for your shopping without worries. Plus, it has a chip for added security, making your purchases even safer.

Why You Might Consider a Different Card than the Citi Double Cash Card

The Citi Double Cash Card is a great choice for many people, but there are a few reasons why you might want to look at other options:

1. No Introductory 0% APR on Purchases

If you’re planning a big purchase and want to avoid interest charges while you pay it off, the Citi Double Cash Card doesn’t offer an introductory 0% APR for new purchases. Some other cards, like the Wells Fargo Active Cash® Card, do have this perk.

2. Mixed Customer Service Reviews

While Citi offers 24/7 customer service and online chat, some reviews say their customer service isn’t as good as other credit card companies.

3. Nothing Special For Students

The Citi Double Cash Card might be a good fit for some students, even though it’s not designed specifically for them. There’s no annual fee, which saves you money. Plus, you earn 2% cash back on everything you buy—1% when you purchase something and another 1% when you pay your bill in full. That’s like getting rewarded twice!

However, there are also some key points to consider before applying for this card:

- No Student-specific Benefits: The card doesn’t offer unique student benefits or rewards, such as discounts on textbooks or travel.

- Requires Good Credit: You’ll need good credit to qualify for the Citi Double Cash® Card. Students who are just starting to build their credit may not be approved.

- High APR: If you don’t pay your balance in full each month, there’s a charge. It’s like a fee for borrowing money. To avoid these charges, it’s important to pay your bill in full each month. Even though the interest rate is high, the Citi Double Cash Card can still be a good option for students with good credit looking for a simple cash-back card that doesn’t have spending category restrictions.

However, Discover the It Student Cashback Credit Card might be a better choice for students.

4. No Benefits Like Car Insurance

The Citi Double Cash Card does not offer car rental insurance as of February 20, 2024. Citi discontinued this benefit for the Double Cash Card and most other cards several years ago. However, several other credit cards on the market offer rental car insurance as a complimentary benefit. If you’re looking for a card with car rental insurance, it’s worth researching other options to find one that meets your needs.

Here are some alternative credit cards with car rental insurance:

- Chase Sapphire Preferred Card: offers primary car rental insurance for damage and theft in most countries worldwide.

- Capital One Venture X Rewards Credit Card provides primary car rental insurance for damage and theft in most countries worldwide.

- Prestige Card from Citi: Offers primary car rental insurance for damage and theft in most countries worldwide.

Application and Approval Process for Citi Double Cash Card

Here’s a complete eligibility criteria, application process and approval odds for Citi Double Cash Credit Card:

Eligibility Criteria

The city double cash card generally accepts applicants with excellent credit, typically starting at a minimum FICO Credit Score of 670–850. However, having a higher credit score can improve your chances of approval and potentially lead to better credit card terms.

Apply Online

- This is the most convenient and quickest method. Visit the official website for the Citi Double Cash Card

- Click on the “Apply Now” button.

- You will be directed to a secure application form.

- Fill out the form with your personal, employment, and income information.

- Please review your application carefully before submitting it.

Apply In-person

- Visit a Citibank branch during their normal business hours.

- Ask a customer service representative for a Citi Double Cash Card application form.

Please fill out the form and submit it to the representative

Approval Odds

Here are some key factors Citi considers when evaluating your application:

- Credit Score: This is a significant factor; a higher score increases your approval chances.

- Payment History: A consistent history of on-time payments demonstrates responsible credit management.

- Credit Utilization: Keeping your credit utilization ratio low (ideally below 30%) shows you can manage credit responsibly.

- Length of Credit History: An extended credit history establishes your experience as a borrower.

- Annual Income: Sufficient income ensures you can meet your credit obligations.

- Other debts: Existing debts can impact your ability to manage additional credit.

- While meeting the minimum requirements might get you considered, more robust applications with a good to excellent credit history and responsible financial management practices have a higher chance of approval.

City Double Cash Card Customer Service

- Contact Number: 1-800-950-5114 (available 24/7)

- Official Website: Citi

Comparison of City Double Cash Card With Other Credit Cards

Conclusion

The Citi Double Cash® Card offers you a 2% cash back on everything you buy. No category rotating, no intro periods to miss, just simple rewards, and no annual fee—it’s the perfect everyday companion for the savvy spender who wants to be rewarded, not restricted. So ditch the rest and double your cash back with the Citi Double Cash Card.

FAQs: Citi Double Cash Card Review

Is Citi Double Cash Card hard to get?

The Citi Double Cash Card has a minimum credit score requirement of Fair to Good (580-669), and the approval process takes into account other factors such as income, debt-to-income ratio, and credit history. While it may not be the easiest card to obtain, if you meet the requirements and have a good credit history, you have a good chance of being approved.

What is the benefit of Citi Double Cash Card?

The main benefit of the Citi Double Cash Card is its cash back program. It offers 2% cash back on all purchases – 1% when you make a purchase and another 1% when you pay off your balance. This makes it an attractive card for those looking to earn rewards on their everyday spending.

What is the credit limit for Citi Double Cash Card?

The credit limit for the Citi Double Cash Card varies depending on your individual creditworthiness and other factors. The minimum credit line is $500, but some users have reported limits of up to $20,000 or more.

Will I qualify for Citi Double Cash Card?

To qualify for the Citi Double Cash Card, you must have a minimum credit score of Fair to Good (580-669).

Specification: 5 Reasons the Citi Double Cash Card is a Top Choice for Shoppers

|