Discover it® Secured Credit Card: Build Credit with Cash Back

The Discover it Secured Credit Card shines with no annual fee and cash back potential. Cashback Match™ doubles all your cash back earned in the first year! Enjoy 2% cash back on gas and restaurants (up to $1,000 quarterly) and 1% on everything else. Responsible use can even lead to a full refund of your security deposit.

Table of Contents

Discover it® Secured Credit Card Review: The Best Way to Build Credit and Earn Rewards

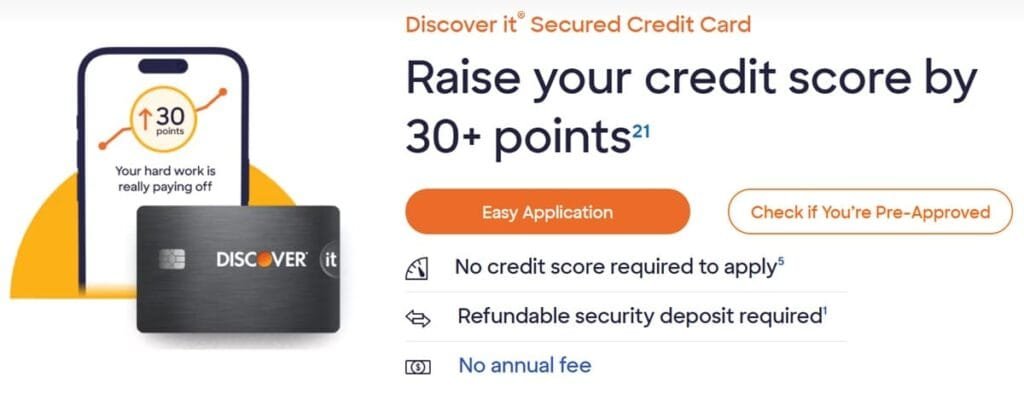

The Discover it® Secured Credit Card is an excellent option for building or rebuilding their credit. With no annual fee, cashback rewards, and the possibility of upgrading to an unsecured card, this secured credit card offers multiple benefits to individuals new to credit or seeking to improve their financial standing.

This comprehensive Discover it® Secured Credit Card review will explore its features, benefits, and how it can help you achieve your financial goals, whether you’re a beginner or rebuilding your credit. We’ll break down everything you need to know from how the card works to the rewards and customer service features that set it apart.

Key Highlights of the Discover it® Secured Credit Card

Here are the quick highlights of the Discover it® Secured Credit Card:

- No annual fee.

- Refundable security deposit required (minimum $200).

- Earn 2% cashback on up to $1,000 in combined gas and restaurant purchases each quarter.

- 1% cashback on all other purchases.

- Build credit with responsible use by reporting to the three major credit bureaus.

- FICO® Credit Score available for free on monthly statements.

- No credit score is required to apply.

- 27.49% Standard Purchase APR (variable).

- $0 Fraud Liability for unauthorized purchases.

- Eligible for an upgrade to an unsecured card after 7 months with on-time payments.

- Accepted at 99% of locations nationwide that accept credit cards.

- No foreign transaction fees.

What is a Secured Credit Card?

A secured credit card is a type of credit card that requires a deposit as collateral to secure the credit line. The credit limit is typically equal to the deposit you make. For example, if you deposit $200, your credit limit will be $200. The Discover it® Secured Credit Card works similarly. This card is specifically designed to help people build or rebuild their credit by providing a straightforward path to demonstrate responsible credit use. However, you can request to increase your credit limit after maintaining a good credit history, as you can lodge a request Apple, to increase a higher limit on your Apple Card.

How the Discover it® Secured Credit Card Works

The Discover it® Secured Credit Card provides an opportunity for individuals with no credit history or those trying to rebuild their credit score. Here’s how it works:

- Security Deposit: To apply for the card, you must provide a refundable security deposit, determining your credit line. The minimum deposit required is $200, but you can deposit more if you’d like a higher credit limit. For example, if you deposit $1500, your credit line will be $1500.

- Building Credit: Your credit line will be equal to your deposit. The card reports your payment history to the three major credit bureaus Experian, TransUnion, and Equifax. Responsible use (making on-time payments) will help you build a positive credit history.

- Automatic Reviews: After 7 months of responsible card use, Discover will conduct monthly account reviews to see if you qualify to upgrade to an unsecured card. If you do, you’ll get your deposit back.

- No Annual Fee: One of the Discover it® Secured Credit Card’s main advantages is that it has no annual fee. This is ideal for those who want to avoid paying extra costs for credit building.

Building Credit with Responsible Use

Building your credit score with a secured credit card requires responsible use. Here are some steps to ensure you build credit effectively:

- Pay Your Bills on Time: Pay your credit card bill on time and in full each month. Your payment history is a significant part of your credit score. Paying your credit card debt on time shows lenders that you are a responsible borrower.

- Keep Your Balances Low: Aim to use no more than 30% of your available credit limit. This is called your credit utilization ratio. Low utilization shows lenders that you are managing your credit wisely.

- Monitor Your Progress: Discover offers free access to your FICO® Credit Score so you can track how your credit is improving. Seeing how your actions impact your score will help you make smarter financial decisions.

Cash Back Rewards with Discover it® Secured Card

One of the standout features of the Discover it® Secured Credit Card is its rewards program. It’s not just a tool for building credit; it can also earn you Cashback on your purchases:

- 2% Cash Back at Gas Stations and Restaurants: Earn 2% cash back on up to $1,000 in combined purchases at gas stations and restaurants each quarter. After reaching the $1,000 cap, you’ll earn 1% cash back on additional purchases.

- 1% Cash Back on All Other Purchases: Whether you’re shopping for groceries, electronics, or other items, you’ll earn 1% cash back on every other purchase.

- Cash Back Match: At the end of your first year, Discover will automatically match all the Cashback you’ve earned. There’s no limit to how much they will match, making this a fantastic way to maximize rewards.

Rewards Redemption

The rewards earned with the Discover It Secured Credit Card never expire, giving cardholders peace of mind and flexibility when redeeming their rewards. If a cardholder’s account is closed or has not been used within 18 months, they reserve the right to determine how the rewards balance will be disbursed.

Discover it®: Secured Credit Card Fees

- Average Cost of Membership Per Year: $3,600 annual spend

- Cash Back Rewards: $0 + $61 in cash back rewards

- Credit Score Required: Excellent

- Security Deposit Required: $200-$2,500

- Initial Credit Limit: $200-$2,500 (equal to your deposit)

- Regular APR: 27.49% Variable Purchase APR

- Annual Fee: No Annual Fee

- Balance Transfer Fee: There is a 3% introductory fee for balances transferred by March 10, 2025, and up to 5% for future transfers.

- Foreign Transaction Fee: 0%

- Cash advance APR: 99% Variable APR

- Cash Advance Fee: 5% of the amount (minimum of $10)

- Late Payment Fee: Up to $41 (waived for first late payment)

- Penalty APR: None

- Returned payment fee: Up to $41

- Minimum Interest Charge: $0.50

Understanding these fees and using the card responsibly is essential to avoid unnecessary charges.

See Full Rewards and Fees Structure

Advantages of Discover it® Secured Credit Card

- No Annual Fee: Many credit cards have an annual fee, but not the Discover it® Secured Credit Card. This makes it more affordable, especially for those looking to build credit without extra costs.

- Refundable Security Deposit: Unlike some secured cards, your deposit is refundable after 7 months if you maintain good standing. This allows you to reclaim your deposit once you’ve built enough credit to transition to an unsecured card.

- Free FICO® Credit Score: Discover provides free access to your FICO® Credit Score, updated regularly. This is an excellent feature for tracking your progress and understanding how your actions affect your score.

- Fraud Protection: Your card is protected by a $0 fraud liability guarantee, meaning you’re not responsible for unauthorized purchases.

- Freeze it® Feature: If you misplace your card or want to prevent unauthorized transactions, you can instantly freeze and unfreeze your card using the Freeze it® feature in the Discover app.

- 99% Nationwide Acceptance: Discover is accepted by 99% of U.S. merchants that accept credit cards, so you won’t have trouble using your card for most purchases.

- Customer Service: Discover offers 100% U.S.-based customer service available 24/7, ensuring you can get help whenever needed.

Comparison: Discover it® Secured Credit Card vs. Bank of America® Customized Cash Rewards Secured Card

When choosing a secured credit card, you want to get the most out of your spending while building your credit. Both the Discover it® Secured Credit Card and the Bank of America® Customized Cash Rewards Secured Card offer unique features. Below is a comparison of the two cards to help you decide which one fits your needs.

| Feature | Discover it® Secured Credit Card | Bank of America® Customized Cash Rewards Secured Card |

| Annual Fee | $0 | $0 |

| Welcome Offer | Cashback match of all rewards earned in the first year | None |

| Card Type | Secured, Credit-builder | Secured, Cash-back |

| Purchase APR | 28.24% variable | 29.24% variable |

| Recommended Credit Score | No credit score required | No credit score required |

| Rewards Rate | 2% cash back at gas stations and restaurants (up to $1,000 per quarter) | 3% cash back in a category of your choice (up to $2,500 each quarter) |

| Cash Back on Other Purchases | 1% cash back on all other purchases | 1% cash back on all other purchases |

| Credit Limit | $200+ security deposit | $200 to $5,000 security deposit |

| Upgrade Options | After 7 months, automatic review for upgrade to unsecured card | Periodic reviews for possible return of security deposit |

| Additional Benefits | Free FICO® Score with monthly statements, no foreign transaction fees | Free FICO® Score, customizable rewards categories |

Key Differences:

- Rewards: The Discover it® Secured Credit Card gives 2% cash back at gas stations and restaurants, while the Bank of America® Customized Cash Rewards Secured Card offers 3% in a category of your choice (gas, dining, online shopping, etc.). However, both cards earn 1% on all other purchases.

- Welcome Offer: Discover offers a generous cash-back match on all rewards earned in the first year, whereas the Bank of America card does not have a welcome offer.

- Flexibility: The Bank of America card stands out for allowing you to customize your reward categories each month, giving more flexibility based on your spending habits.

- Credit Limit: The Bank of America card allows a larger range for the security deposit, from $200 to $5,000, while Discover starts at $200.

Why Choose the Discover it® Secured Credit Card?

- If you’re looking for an easy way to earn rewards without the need to manage categories, the Discover it® Secured Credit Card is a great choice. Its 2% cash back at gas stations and restaurants can add up quickly, especially with no annual fee.

Why Choose the Bank of America® Customized Cash Rewards Secured Card?

- If you prefer to customize your rewards and want 3% cash back in a category of your choice, the Bank of America® Customized Cash Rewards Secured Card is the better fit. This card also allows you to earn 2% cash back at grocery stores, making it ideal for varied spending.

Both cards offer excellent options for building credit while earning rewards, but the best choice depends on your spending patterns and preferences for rewards flexibility.

Application Requirements for the Discover it® Secured Credit Card

While the Discover it® Secured Credit Card is an excellent choice for beginners, it’s still essential to meet specific requirements for approval:

- No Credit Score Needed: Even if you have no credit history, you may still be able to qualify for the Discover it® Secured Credit Card.

- Security Deposit: You must make a refundable security deposit of at least $200 to secure your credit line. The amount you deposit will determine your credit limit.

- Application Process: There is no hard inquiry on your credit report to check if you’re pre-approved, but once you submit your full application, a hard inquiry will be made, which may affect your score.

How to Get Your Deposit Back

One of the major selling points of the Discover it® Secured Credit Card is the possibility of getting your deposit back:

- Automatic Reviews: After 7 months of responsible use, Discover will begin monthly reviews of your account to determine if you qualify to upgrade to an unsecured card.

- On-Time Payments: To be eligible for an upgrade and get your deposit back, you must have made at least six consecutive months of on-time payments. Your credit history with Discover and any other accounts will be considered.

- Refund Process: If you qualify, Discover will process your refund within 2-3 business days, and your deposit will be returned to your account.

Customer Service/Phone Number

- Credit Card Fraud: 1-800-347-2683

- Fraud Investigation:1-800-347-7466

- Cardholder Services:1-866-240-7938

- Official Website: Discover

Is the Discover it® Secured Credit Card Right for You?

The Discover it® Secured Credit Card is ideal for anyone looking to build or rebuild their credit. Whether you’re a student, a first-time credit card holder, or someone working to improve your credit score, this card provides the tools you need to succeed. With its cashback rewards, no annual fee, and refundable deposit, it stands out as one of the best-secured cards on the market.

However, it may not be the right fit if you’re uncomfortable with the idea of a security deposit or are already gathering a better one. However, the Discover it® Secured Credit Card can be your second credit card that offers a pathway to better credit and more significant financial opportunities for those seeking to build a solid financial foundation.

Meta Descriptions

- Are you looking to build or rebuild your credit? The Discover it® Secured Credit Card offers Cashback, no annual fee, and a refundable deposit.

Meta Titles

- Discover it® Secured Credit Card: Build Credit with Cash Back.

- How the Discover it® Secured Credit Card Can Help You Build Credit

- Discover it® Secured Credit Card Review: No Annual Fee & Great Rewards.

- Get Your Deposit Back with Discover it® Secured Credit Card.

- The Best Secured Credit Card for Building Credit and Earning Cash Back

FAQs: Discover it Secured Credit Card Review

What is the minimum security deposit?

The Discover it® Secured Credit Card requires a refundable security deposit of at least $200 to open an account. The deposit amount will determine the cardholder’s credit line, up to $2,500.

What are the benefits of the card?

The Discover it® Secured Credit Card offers 2% cash back at restaurants and gas stations, up to $1,000 in combined purchases per quarter, and 1% cash back on all other purchases.

How does the deposit work?

The security deposit serves as collateral for the credit line. This means the deposit secures the cardholder’s purchases up to their credit limit. However, the cardholder is still required to make the minimum monthly payment.

Can the deposit be increased?

Cardholders can increase their credit limit by increasing their security deposit amount. This can help them manage their spending and improve their credit score. This can lead to more financial flexibility and opportunities for the cardholder.

What is a secured credit card?

A secured credit card is a type of credit card that requires a cash security deposit when you open the account. This deposit acts as collateral for the credit limit and helps to minimize risk for the credit card company.

Why would someone choose a secured credit card?

People may choose a secured credit card if they have a limited or poor credit history, as it can help them build or rebuild their credit. It may also be a good option for someone who wants to practice responsible credit habits without the risk of overspending.

Specification: Discover it® Secured Credit Card: Build Credit with Cash Back

|