Top 9 Benefits of the Southwest Rapid Rewards Plus Credit Card You’ll Love

The Southwest Rapid Rewards Plus offers 25% back on inflight with 3x points & bonus points on everyday spending Southwest purchases. Earn up to 100,000 bonus points, a hefty 60,000 points after spending $3,000 in purchases in the first three months, plus an additional 40,000 points after spending $9,000 total in purchases within the first year. 3X Multiply your points on local transit, internet, cable & phone, and rack up rewards even faster.

Table of Contents

Southwest Rapid Rewards plus Credit Card Review

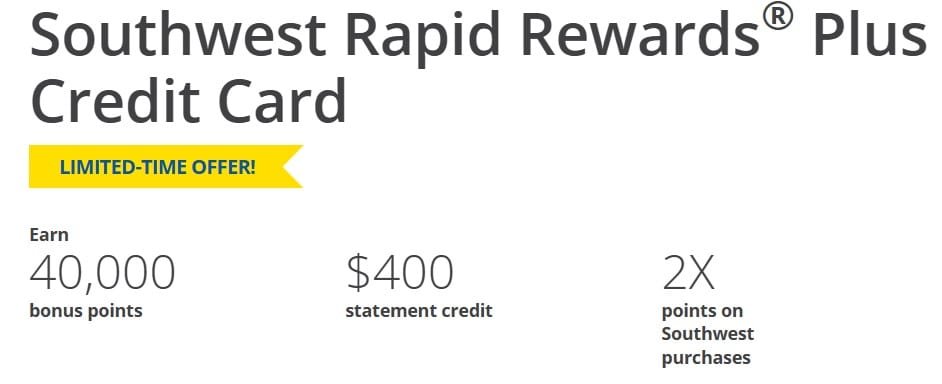

The Southwest Rapid Rewards® Plus Credit Card is in great demand travel credit card that offers exceptional benefits and rewards for its cardmembers. With an annual fee of only $69, it provides significant value with 40,000 bonus points and the opportunity to earn Companion Pass® through 2/28/2025. Cardholders can also enjoy 3,000 anniversary points each year, 2X points on Southwest® purchases and 1X points on all other purchases.

In this comprehensive article, we will review Southwest Rapid Rewards® Plus Credit Card and all the exclusive benefits and perks it offers to its cardmembers. Keep reading to find out why this credit card is a top choice for frequent travelers.

Quick Highlights

- Earn Companion Pass 40,000+ points after you spend $4,000 on purchases in the first three months from account opening.

- 3,000 anniversary points each year.

- 2 Early Bird Check-In each year.

- Earn 2X points on internet, cable, and phone services; select streaming.

- Get 2X points on local transit and commuting, including rideshare.

- Receive 2X points on Southwest purchases.

- Earn 1 point for every $1 spent on all other purchases.

What is Southwest Rapid Rewards Plus Credit Card

The Southwest Rapid Rewards Plus Visa Signature Card is not only a vessel to Southwest Airlines’ rewards but it also broadens the horizon with additional perks for cardholders. The card, specifically beneficial for loyalists of Southwest Airlines. It offers a rewards rate of 2 points for every dollar spent on Southwest purchases and on daily services, including local transit, commuting, internet, cable, phone services, and select streaming platforms.

Rewards and Features

Sign-up Bonus

Limited-time offer: Earn Companion Pass good through 2/28/25 plus 40,000 points after you spend $4,000 on purchases in the first three months from account opening.

Rewards

- 2 points per dollar spent on Southwest purchases and Rapid Rewards® hotel and car rental partner purchases.

- Two points per dollar spent on local transit and commuting, including rideshare.

- 2 points per dollar on internet, cable, phone services, and select streaming.

- 1 point per dollar spent on all other purchases.

No Expiration, No Limits

Points earned have no expiration date and can be redeemed for airfare, gift cards, merchandise, car rentals, cruises, hotel stays, and exclusive event access. There are no blackout dates or limits on rewards seats, offering unrestricted access to flights provided you have enough points to book them.

Travel Made Convenient

The card encourages travel convenience, waiving change fees, and booking fees. While stopovers on reward tickets aren’t allowed, cardholders do have the liberty to book one-way rewards tickets, offering flexibility to those with open-ended travel plans.

A Suitcase Full of Features

Low Annual Fee

The $69 annual fee is relatively low for an airline card with a healthy sign-up bonus and ongoing bonus rewards on airline purchases.

Extra Anniversary Points

You’ll receive an anniversary bonus of 3,000 points each year you keep your card account open. (You can also earn extra points by booking car rentals and hotels through the Rapid Rewards program or using the Rapid Rewards Shopping portal.

With this card, travelers can enjoy:

- Early-Bird check-ins twice a year.

- A generous 25% back on inflight purchases.

- Insurance advantages, including rental car, baggage delay, lost luggage reimbursement, travel accident insurance, and more.

- Roadside dispatch, travel, and emergency assistance services for the unforeseen.

- Extended warranty and purchase protection for a secure buying experience.

- 10,000 Companion Pass qualifying points boost each year.

- 2 Early Bird Check-In: each year.

- 25% back on inflight purchases.

The Other Side of the Runway

It’s essential to consider the entire landscape when choosing a credit card, and the Southwest Rapid Rewards Plus card has some areas where it may fall short for some users:

- International travel options with the card are somewhat restricted.

- Rewards flights can only be booked through Southwest Airlines, limiting flexibility if you’re looking to fly with other carriers.

- There are cards, such as the Chase Sapphire Preferred or the United Explorer Card, which offer potentially better value for specific needs in comparison.

Rates and Fee: Southwest Rapid Rewards Plus Credit Card

Here are the different fees for using this card:

- Annual Fee: $69.

- Foreign Transaction: 3% per transaction

- Late fees: up-to 40$

- Over Limit Fee: None

- balance Transfer Fees: Either $5 or 5%

- Grace periods: In case of late payments of 21 days.

- Regular APR: 20.74% – 27.74% (Variable)

- Intro Purchase APR: 0% for 12 months on purchases

- Intro Balance Transfer APR: Not offered

- Balance Transfer Fee: 5% of each transferred amount, $5 minimum

- Card Limit: Varies based on creditworthiness (typically $5,000 – $25,000)

Benefits of Southwest Rapid Rewards® Plus Credit Card

1. Redeem for More Than Just Flights

With the Southwest Rapid Rewards® Plus Credit Card, you can redeem your points for more than just flights. Use them to book hotel stays, car rentals, gift cards, access exclusive events and even purchase merchandise.

2. Contactless – Just Tap To Pay

Take advantage of fast, easy and secure checkout with the Southwest Rapid Rewards® Plus Credit Card. Simply tap to pay wherever you see the Contactless symbol.

3. DoorDash Benefits

Receive one year of complimentary DashPass membership when you activate by 1/31/25. This membership provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders for both DoorDash and Caviar. After the complimentary year, you will be automatically enrolled in DashPass at the current monthly rate.

4. Travel & Purchase Coverage

With built-in travel and purchase benefits, the Southwest Rapid Rewards® Plus Credit Card has you covered.

5. Lost Luggage Reimbursement

If your luggage is lost or damaged by the carrier, you and your immediate family members are covered for up to $3,000 per passenger.

6. Baggage Delay Insurance

For delays over 6 hours by a passenger carrier, this benefit reimburses you for essential purchases like toiletries and clothing up to $100 a day for 3 days.

7. Extended Warranty Protection

On eligible warranties of three years or less, this benefit extends the time period of the U.S. manufacturer’s warranty by an additional year.

8. Purchase Protection

New purchases made with your Southwest Rapid Rewards® Plus Credit Card are covered for 120 days against damage or theft up to $500 per claim and $50,000 per account.

9. Instant Access and My Chase Plan

Apply for the Southwest Rapid Rewards® Plus Credit Card and receive instant access by adding it to a digital wallet such as Apple Pay®, Google Pay™ or Samsung Pay. Additionally, you can take advantage of My Chase Plan to break up eligible purchases into budget-friendly payments with no interest. Simply pay a fixed monthly fee and track your payment progress on chase.com or the Chase Mobile® app.

Comparison: Southwest Rapid Rewards Plus vs. Premier vs. Priority Credit Card

When it comes to comparison, the Southwest Rapid Rewards Plus card stands alongside the Premier card and does face stiff competition from it in certain respects. The Premier version might tip the scales for some users with its additional features.

Here’s a complete comparison breakdown with respect to annual fee, welcome bonus, earning rewards points, travel benefits and A-list status.

Annual Fee

Welcome Bonus

- Plus: 60,000 points after spending $3,000 in purchases in the first three months.

- Premier: 75,000 points after spending $4,000 in purchases in the first three months.

- Priority: 125,000 points after spending $5,000 in purchases in the first three months.

Earning Points

- Plus: 2 points per dollar on Southwest purchases and 1 point per dollar on everything else.

- Premier: 3 points per dollar on Southwest purchases, 2 points per dollar on Rapid Rewards partner hotels and car rentals, and 1 point per dollar on everything else.

- Priority: 3 points per dollar on Southwest purchases and car rentals, 2 points per dollar on Rapid Rewards partner hotels and international flights, and 1 point per dollar on everything else.

Travel Benefits

- Plus: None.

- Premier: Two upgraded boardings per year, in-flight Wi-Fi credits.

- Priority: Four upgraded boardings per year, $75 annual Southwest travel credit, 25% back on in-flight purchases, tier qualifying points boost.

A-List Status

- Plus: None.

- Premier: Earn tier qualifying points (TQPs) 2X faster towards A-List status.

- Priority: Earn tier qualifying points (TQPs) 2X faster towards A-List status.

Verdict

- Southwest Rapid Rewards Plus Credit Card: Ideal for infrequent Southwest flyers who want a simple rewards card with a decent welcome bonus.

- Southwest Rapid Rewards Premier Credit Card: Good for frequent Southwest flyers who value hotel and car rental rewards, occasional upgraded boarding, and in-flight Wi-Fi.

- Southwest Rapid Rewards Priority Credit Card: Best for frequent Southwest travelers who fly internationally seek premium travel benefits like annual travel credit, in-flight discounts, and faster access to A-List status.

Note: See Full Comparison of Southwest Rapid Rewards Plus vs. Premier vs. Preferred Credit Card

Southwest Rapid Rewards Plus Credit Card Approval Process

Applying for the Southwest Rapid Rewards Plus Credit Card is a straightforward process. You can complete it online in minutes through Chase’s website or visit a local branch for in-person assistance.

Approval typically takes minutes, with an instant decision in many cases. You’ll receive notification via email or phone. If approved, your card will arrive in the mail within 7-10 business days.

Here are some key points to remember:

- Minimum Credit Score: While Chase doesn’t officially disclose the minimum, a score of 670 is generally recommended.

- Documents Needed: Be ready to upload scanned copies of your government-issued ID and proof of income (pay stub, tax return, etc.

- Reconditioning Options: If you’re initially denied, Chase may offer reconsideration if you call and explain your situation.

Customer Service and Contact Number

- Customer service: 1-800-792-0001

- Contact via official website: Southwest Rapid Rewards plus Credit Card

Conclusion

Specification: Top 9 Benefits of the Southwest Rapid Rewards Plus Credit Card You’ll Love

|