American Express Platinum Card®: Everything You Need to Know

The Platinum Card from American Express offers a high annual fee of $695, but with multiple travel benefits and perks, it is perfect for frequent travellers. With 5X points on flights and prepaid hotel bookings made directly through American Express Travel, card members can quickly recoup the cost. Plus, there’s an impressive welcome bonus of 125,000 points if you spend $8,000 within the first six months. Discover even more benefits and perks with this elite travel card.

Table of Contents

Review of the Platinum Card® from American Express: A Luxury Travel Credit Card Worth Every Penny

The Platinum Card® from American Express has long been regarded as one of the top luxury credit cards, offering exclusive benefits and rewards for travelers, shoppers, and those seeking a premium experience. This comprehensive review covers the key aspects of the card, including its benefits, fees, and features, to help you decide if it’s the right fit for your lifestyle.

Overview: The Platinum Card® from American Express

The Platinum Card® from American Express is designed for individuals who appreciate luxury and seek to maximize their travel and shopping experiences. This travel rewards credit card offers a wealth of benefits, from airport lounge access to exclusive shopping perks, making it a top choice for those who want to elevate their lifestyle.

Card Highlights: American Express Platinum Card®

- Earn 125,000 Membership Rewards® Points after spending $8,000 in the first 6 months.

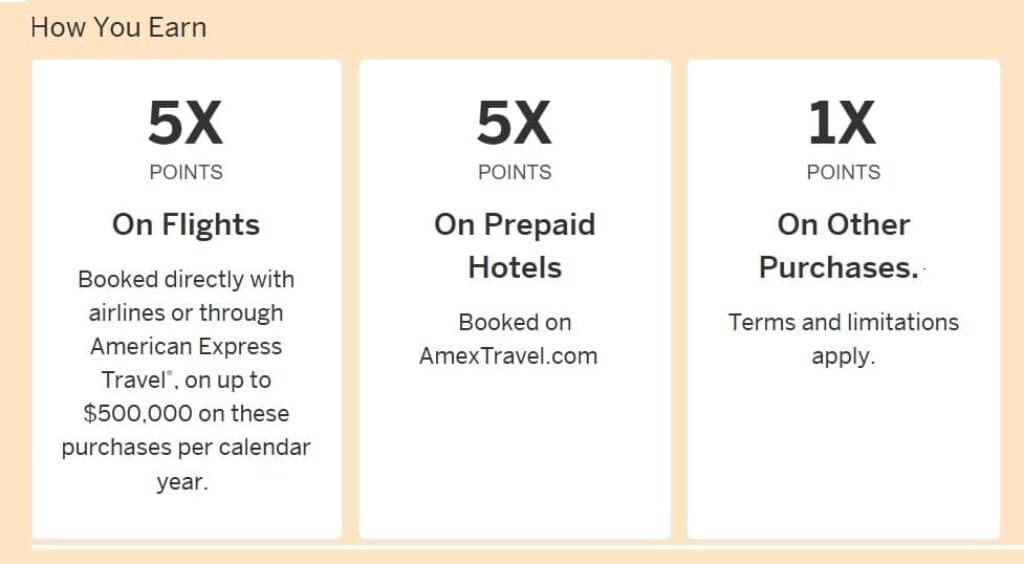

- 5X Membership Rewards® points on flights booked directly with airlines or through Amex Travel.

- 5X Membership Rewards® points on eligible prepaid hotels booked through American Express Travel.

- $200 Uber Cash annually for U.S. rides and Uber Eats orders.

- $240 Digital Entertainment Credit for Disney+, Hulu, and The New York Times subscriptions.

- $100 hotel credit and room upgrades at over 1,000 Fine Hotels + Resorts properties.

- Airport Lounge Access with Priority Pass Select, Centurion Lounges, and more than 1,400 lounges worldwide.

- $100 hotel credit at The Hotel Collection for bookings of two nights or more.

- TSA PreCheck/Global Entry credit to cover application fees for expedited airport security.

- Up to $199 CLEAR membership credit for faster security clearance at select airports.

- $100 Saks Fifth Avenue credit annually (split into two $50 credits).

- Plan It® feature allows you to split large purchases into monthly payments.

- Exclusive Global Dining Access to top restaurants with special reservations and experiences.

- Travel insurance benefits, including trip cancellation and interruption insurance.

- Purchase Protection and Return Protection on eligible purchases for added peace of mind.

- Cell phone protection when you pay your bill with the Platinum Card®.

Rates and Fees: Platinum Card® from American Express

The Annual Fee Platinum Card is higher than other cards, currently set at $695 (as of 2025). However, this Fee is easily offset by the incredible benefits and rewards the card offers. Cardholders often find that the value of travel credits, insurance, and luxury perks far exceeds the cost of the Fee. However, here’s the list of the most important rates and fee for the card:

- Annual Fee: $695 (as of 2025)

- Purchase APR: 20.99% – 28.99% variable, based on creditworthiness and the Prime Rate.

- Cash Advance APR: 29.99% variable.

- Penalty APR: 29.99% variable (applied for late payments or returned payments).

- Late Payment Fee: Up to $40.

- Returned Payment Fee: Up to $40.

- Foreign Transaction Fees: $0 (No fees for international transactions).

- Cash Advance Fee: The greater of $5 or 3% of the amount of each cash advance.

- Overlimit Fee: $0.

- Balance Transfer Fee: $0 (Balance transfers are not allowed).

- Additional Cardholder Fee: $195 per additional cardholder.

- Express Cash Transfer Fee: Varies based on the transaction.

Why You Might Want the American Express Platinum Card®

The Platinum Card® from American Express is designed for individuals who value luxury, convenience, and top-tier travel experiences. Although it comes with a high annual fee, its rewards and benefits can easily outweigh the cost for those who make the most of its features.

Here’s an in-depth look at why you might want to consider the Platinum Card from American Express.

Generous Welcome Offer

The Platinum Card® from American Express offers a substantial welcome bonus to new cardholders. When you spend $8,000 on eligible purchases within the first six months, you’ll earn 125,000 Membership Rewards® points. While this is slightly down from previous offers, it is still a generous reward.

If you redeem these points through American Express Travel, each point is worth approximately 1 cent, making the total welcome bonus worth $600. You can use these points for airfare, hotel stays, or other travel-related expenses, depending on your travel preferences. This provides significant flexibility, allowing you to kickstart your Journey with valuable rewards right from the start.

Luxury Lounge Access

One of the most coveted perks of the American Express Platinum Card is the Global Lounge Collection, which gives you access to more than 1,400 airport lounges worldwide. This includes Priority Pass, Delta Sky Club, Airspace Lounges, and the exclusive Centurion Lounges only available to Platinum cardholders.

With this benefit, you can avoid the stress of crowded airports and enjoy a more comfortable travel experience. The primary cardholder and authorized users can access the lounges and bring up to two guests at no extra charge.

Top-Notch Travel Perks

In addition to lounge access, the Platinum Card® from American Express has an impressive suite of travel benefits designed to elevate your entire travel experience. Some of the standout perks include:

- Platinum Card Travel Insurance: The card provides comprehensive travel insurance benefits, such as trip cancellation and interruption insurance, covering up to $10,000 in non-refundable expenses per trip.

- Up to $200 in airline fee credits: You can use this credit to cover incidental fees such as checked bag charges or in-flight refreshments with your selected airline.

- Up to $200 in Uber credits annually: Get up to $15 each month (with a $20 bonus in December) for Uber rides, including Uber Eats orders in the U.S.

- Hotel credits: Cardholders can earn up to $100 in statement credits each year when booking at eligible Fine Hotels + Resorts® or The Hotel Collection properties.

- Elite Hotel Status: Automatic Marriott Bonvoy Gold Elite and Hilton Honors Gold status, offering room upgrades, late checkout, and other exclusive perks during hotel stays.

These benefits can save you significant money and enhance your travel experience, especially if you frequently travel for business or pleasure.

Luxury Travel Perks and Rewards

As a Platinum cardholder, you can enjoy access to premium services, such as exclusive dining reservations through the American Express Global Dining Access by Resy and invitations to special events through the Premium Events Collection™. Additionally, you earn 5X Membership Rewards® points on flights and prepaid hotels booked through American Express Travel, providing incredible value for frequent travelers.

Uber Cash and Hotel Credits

Platinum cardholders receive up to $200 in Uber Cash annually for U.S. rides and Uber Eats, further enhancing the card’s travel benefits. In addition, enjoy a $100 hotel credit at Fine Hotels + Resorts properties, allowing you to experience luxury stays while earning valuable perks.

Digital Entertainment Credits

With the Platinum Card® from American Express, you can receive a $240 Digital Entertainment Credit annually, which can be used towards subscriptions like Disney+, Hulu, The New York Times, and more. This adds extra value for entertainment and streaming lovers.

Shopping and Purchase Protections

The Platinum Card® includes several shopping protections like Purchase Protection, Return Protection, and Extended Warranty benefits, which provide peace of mind on eligible purchases.

Walmart+ Credit and Saks Fifth Avenue Benefits

For frequent shoppers, the card offers up to $12.95 in monthly credits for Walmart+ memberships and up to $100 in annual statement credits for Saks Fifth Avenue purchases (split into two $50 credits). This makes it easier to enjoy luxury shopping and added convenience.

Amex Offers and Flexible Payment Options

The card also offers Amex Offers, which allow cardholders to earn rewards on select purchases from partnering brands. Plus, with the Plan It® option, you can split large purchases into manageable monthly payments, providing financial flexibility.

Extensive Transfer Partners

The American Express Platinum Card gives you access to an extensive list of airline and hotel transfer partners. If you frequently fly or stay at major hotel chains, you can transfer your Membership Rewards® points to these programs for incredible value.

For example, Amex allows you to transfer points at a 1:1 ratio to airline partners such as Delta Airlines, British Airways, Singapore Airlines, and JetBlue, among many others. This means that for every point you earn, you can transfer it to your preferred frequent flyer program and book flights at a competitive rate.

For frequent travelers, earning 5X Membership Rewards® points on flights and prepaid hotel bookings is also a huge plus. This helps you quickly accumulate points for future redemptions.

American Express Transfer Partners

| Partner | Transfer Ratio |

|---|---|

| Singapore KrisFlyer | 1.5:1 |

| Iberia Plus | 1:01 |

| Aeromexico | 01:01.6 |

| Delta SkyMiles | 1:01 |

| Avianca LifeMiles | 1:01 |

| Aeroplan | 1:01 |

| All Nippon Airways (ANA) | 1:01 |

| British Airways | 1:01 |

| JetBlue | 1.25:1 |

| Asia Miles | 1:01 |

| Etihad Guest | 1:01 |

| Emirates Skywards | 1:01 |

| Hawaiian Airlines | 1:01 |

| Aer Lingus | 1:01 |

| Flying Blue | 1:01 |

| Virgin Atlantic | 1:01 |

| Qantas | 1:01 |

| Hilton Honors | 1:02 |

| Marriott Bonvoy | 01:01.5 |

| Choice Privileges | 1:01 |

As you can see, Amex Platinum cardholders can transfer their points to some of the most valuable and popular airline and hotel programs, allowing you to plan your next trip using your accumulated rewards easily.

Amex Platinum Card is Worth Its Annual Fee

While the Platinum Card comes with a hefty annual fee, it offers a range of premium perks that can easily offset this cost. Let’s take a closer look at the annual value of some key benefits:

Table

As you can see, the total annual value of the benefits you receive with the American Express Platinum Card can easily surpass the annual Fee. This makes it a worthwhile investment for those who utilize these perks regularly.

Additional Benefits

Beyond the high-value travel and lifestyle credits, the Platinum Card offers other benefits designed to protect your purchases and provide peace of mind during your travels:

- No foreign transaction fees: Unlike many credit cards, the Platinum card does not charge foreign transaction fees, making it an excellent option for international travelers.

- Purchase protection: If you purchase with your Platinum card and it is damaged or stolen, you may be reimbursed for the cost.

- Return protection: The Platinum card extends the ability to return eligible purchases up to 90 days after purchase.

- Cellphone insurance: Pay your monthly cellphone bill with your Platinum card, and you’ll be covered for damage or theft (up to $800 per claim).

- Baggage insurance: American Express offers coverage for lost or damaged baggage when you pay for a trip with your Platinum card.

Excellent Customer Experience

American Express is well-known for providing top-tier customer service, and Platinum Cardholders enjoy premium support. The company scored first in the J.D. Power 2021 Customer Satisfaction survey, and cardholders benefit from 24/7 customer service, including a helpful chat feature on the American Express website.

The American Express mobile app is highly rated, offering an intuitive experience for managing your account, paying bills, and tracking rewards.

Is the Platinum Card® from American Express Worth It?

For frequent travelers, luxury enthusiasts, and those seeking significant rewards, the Platinum Card® from American Express provides unmatched value. The card’s premium benefits, like access to airport lounges, hotel credits, and travel insurance, justify the annual Fee for many cardholders.

The Platinum Card’s annual Fee might seem high at first glance, but the Platinum Card benefits far outweigh the cost for those who take full advantage of the travel credits, shopping perks, and Membership Rewards® points accumulation. The card is ideal for those who travel regularly and seek higher service, comfort, and flexibility.

How to Maximize Your American Express Platinum Card® Benefits

To make the most of your Platinum Card® membership, it’s essential to use the card for its key benefits:

- Book Travel via American Express Travel: Earn 5X Membership Rewards® points on eligible flight and hotel bookings.

- Use Your Hotel Credits: Book your stays at Fine Hotels + Resorts or The Hotel Collection to unlock additional perks, like room upgrades and a $100 hotel credit.

- Leverage Airport Lounge Access: Take advantage of the Global Lounge Collection, which includes access to airport lounges worldwide.

- Enjoy Digital Entertainment Benefits: Maximize your $240 digital entertainment credit by subscribing to Disney+ or The New York Times services.

- Shop with Saks Fifth Avenue and Walmart+: Use your card’s shopping credits to save on luxury items and streaming subscriptions.

Why You Might Want a Different Rewards Card

While the Platinum Card® from American Express offers plenty of travel perks and benefits, it may not be the best choice for everyone. If maximizing rewards is your priority, other credit cards could provide better value.

Low Rewards Earning Potential

The Amex Platinum provides 5X points on flights booked with airlines or through American Express Travel and 5X on prepaid hotels booked with Amex Travel. While these are sometimes competitive, they don’t compare to other premium cards. For example, the Chase Sapphire Reserve® offers 5X points on flights and 10X points on hotels and car rentals booked via Chase Travel.

The Capital One Venture X offers similar 5X miles on flights but adds 10X miles on hotels and car rentals, along with a flat 2X miles on other purchases. These cards can help you rack points faster than the Platinum Card’s limited bonus categories.

Related: Why Does Rently Ask For Credit Card?

Comparatively Poor Point Value

The Membership Rewards® points earned with the Platinum Card are worth just 1 cent when redeemed through American Express Travel. Some redemption options offer less value, making it harder to maximize your rewards. For instance, redeeming points for a statement credit only nets you 0.6 cents per point.

In comparison, other premium cards, such as the Chase Sapphire Reserve, provide higher-than-1-cent value when points are used for travel bookings through the issuer’s portal.

High Annual Fee

The Platinum Card has one of the highest annual fees in the industry. While you can offset it with luxury perks, you might find better value with cards that offer broader rewards opportunities at a lower cost.

Amex Platinum Redemption Options

| Redemption Option | Point Value (Cents) |

|---|---|

| Airfare through American Express Travel | 1 |

| Charity Donation | 1 (up to 500,000 points, 0.5 cent thereafter) |

| Uber/NYC Taxi | 1 |

| Airline Upgrade | 1 |

| Gift Cards | Up to 1 |

| Other Travel Purchases (Amex Travel) | 0.7 |

| Expedia Travel | 0.7 |

| Shopping Partner (Amazon, Best Buy, etc.) | 0.7 |

| Statement Credit | 0.6 |

| Excise Tax Offset Fee (for transfer to travel partner) | 0.5 |

The table illustrates the different redemption options for Amex Platinum points, highlighting how some options offer lower value than others in the rewards landscape.

How Does the American Express Platinum Compare with Other Premium Rewards Cards?

The Amex Platinum is a standout card known for its high-end benefits like lounge access, hotel credits, and elite status. However, its $695 annual fee may not justify the value for everyone. While it offers 5X points on flights and hotels, it lacks the broader earning potential seen in other premium cards.

The Chase Sapphire Reserve® offers a more flexible $300 travel credit, a higher point value (1.5 cents per point) when redeemed for travel, and an excellent 3X on dining. The Capital One Venture X card, priced at $550 annually, also provides substantial travel benefits, including 2X miles on all purchases and 10X on hotels.

Meanwhile, the American Express® Gold Card focuses on high rewards rates in everyday categories like restaurants and supermarkets. It offers 4X points on dining and supermarkets and a lower $325 annual fee compared to the Platinum.

If you’re looking for a card with more diverse rewards and lower costs, cards like the Chase Sapphire Reserve® and Capital One Venture X could be better choices for accumulating points more quickly.

Comparison: Amex Platinum vs Chase Sapphire Reserve® vs Capital One Venture X Rewards Credit Card vs American Express® Gold Card

| Feature | Amex Platinum | Chase Sapphire Reserve® | Capital One Venture X | Amex Gold |

|---|---|---|---|---|

| Annual Fee | $695 | $550 | $395 | $325 |

| Welcome Bonus | 125,000 points | 60,000 points | 75,000 miles | 90,000 points |

| Points on Travel | 5X on flights | 5X on flights | 5X on flights | 3X on flights |

| Points on Hotels & Car Rentals | 5X on prepaid hotels | 10X on hotels & car rentals | 10X on hotels & car rentals | None |

| Points on Dining | None | 3X on dining | 2X on dining | 4X on dining |

| Points on Other Purchases | 1X | 1X | 2X on all other purchases | 1X |

| Global Entry/TSA PreCheck Credit | Up to $100 | Up to $120 | Up to $100 | None |

| Lounge Access | 1,400+ lounges | Priority Pass Select | Unlimited Priority Pass + Capital One Lounges | None |

| Other Travel Perks | $200 Uber Cash, $200 airline fees, $240 digital credits, hotel credits | $300 travel credit, $100 hotel credit | $300 travel credit, Hertz Elite status | $120 dining credit |

| Additional Cardholders Fee | $195 | $75 | Free | $195 |

| Redemption Value for Travel | 1 cent per point (Amex Travel) | 1.5 cents per point (Chase Travel) | N/A | N/A |

| Dining & Restaurant Credits | None | N/A | N/A | Up to $120 (Dining credits) |

| Other Credits/Bonuses | $100 Saks, $240 digital credits | N/A | 10,000 anniversary bonus miles | N/A |

| Other Features | Elite hotel status, Global Dining Access | 50% point boost on travel | Free additional cards, Hertz Elite | Car rental insurance, hotel benefits |

Comparison Analysis

From the comparison table, here’s how each card fares:

- Annual Fee: The Amex Platinum is the most expensive at $695 but offers top-tier perks. Chase Sapphire Reserve® and Capital One Venture X offer similar luxury benefits at lower annual fees of $550 and $395, respectively. The Amex Gold is the most affordable at $325.

- Welcome Bonus: The Capital One Venture X provides the highest welcome bonus (75,000 miles), while the Amex Platinum offers 125,000 points.

- Points on Travel and Hotels: The Amex Platinum and Chase Sapphire Reserve® provide competitive rates on travel. However, Chase Sapphire Reserve® excels with 10X points on hotels and car rentals, compared to Amex Platinum’s 5X on prepaid hotels.

- Dining & Restaurant Credits: The Amex Gold stands out for its 4X dining rewards and up to $120 in annual restaurant credits, making it the best for foodies.

- Lounge Access: Amex Platinum offers access to more than 1,400 lounges, including exclusive Centurion Lounges. Chase Sapphire Reserve® provides Priority Pass Select, while Capital One Venture X offers unlimited lounge access.

- Travel Perks: Chase Sapphire Reserve® provides a valuable $300 travel credit. Meanwhile, Amex Platinum offers extensive travel benefits, such as $200 Uber Cash and hotel credits.

Which Card is Worth Buying?

The Amex Platinum offers unbeatable value for those seeking luxury travel perks and elite status benefits. With access to lounges, travel insurance, and substantial credits, the $695 fee is easily offset for frequent travelers.

If you’re looking for a lower annual fee with flexible point redemption, the Chase Sapphire Reserve® is a top contender. Its 1.5 cents per point travel redemption rate provides great travel flexibility and excellent dining rewards.

Capital One Venture X is a solid choice for those who prefer affordable luxury with travel rewards. It combines unlimited lounge access, a 75,000-mile bonus, and a lower annual fee.

The Amex Gold is ideal for food lovers who enjoy dining rewards. It offers 4X points on dining and valuable restaurant credits, making it an excellent choice for everyday spenders.

Is the Amex Platinum Card Right for You?

The American Express Platinum Card is best suited for frequent travelers who value luxury. Its high annual Fee may be a barrier for some, but if you regularly take advantage of its travel perks, elite status benefits, and various credits, the card can more than justify its cost.

If you love luxury travel, enjoy airport lounges, or are looking for a way to maximize your travel rewards, the Amex Platinum Card might be the perfect fit. Remember that the card is designed for individuals with excellent credit, so make sure your credit history aligns with the card’s requirements before applying.

The Platinum Card® from American Express is a robust credit card for frequent travelers and those seeking high-end perks. Its wealth of benefits, transfer partners, and travel credits provides unparalleled value to cardholders who can take full advantage of these offers. Whether you’re a business traveler or a luxury vacationer, the Platinum Card has much to offer if used wisely.

Related: Business Platinum Card from American Express: Comprehensive Review

How to Use the Platinum Card from American Express

To maximize your American Express Platinum Card, taking full advantage of its benefits is essential. Start by using available credits to offset the high annual Fee. Enroll in Hilton Honors Gold and Marriott Bonvoy Gold Elite status for perks like room upgrades. You can also add an authorized user for $195, allowing them to access your card’s benefits.

Don’t forget to utilize purchase protection and baggage insurance for extra security on your travel purchases. Linking your Platinum Card to your Uber account will earn you up to $200 in Uber Cash credits each year.

If you don’t have enough Membership Rewards points for airfare, you can use fewer points for an airline upgrade, though the value may be less. Reviewing all features regularly ensures you’re making the most of everything the Platinum Card offers.

Application and Approval Process

- Eligibility: The Platinum Card® has stricter requirements than standard cards, including a good to excellent credit score and sufficient income.

- Application process: You can apply online or through the American Express app. Be prepared to provide basic information, income details, and employment history.

- Annual fee: The card comes with a hefty annual fee, so ensure you can comfortably justify the cost based on your spending habits and the value you’ll derive from the benefits.

- Age Requirements: Applicants must be at least 21 years old to apply for the Platinum Card from American Express. If you are under 21, you may still be able to use it if you have a co-signer or proof of independent income.

- Income Requirements: The Platinum Card® from American Express is designed for individuals with a higher income level. While there is no specific income requirement listed, it is recommended that applicants have an annual income of at least $50,000 to be considered.

- Existing American Express Cardholders: If you currently have another American Express credit card, you may still be eligible for the Platinum Card®. However, eligibility will depend on your current credit standing and account history with American Express.

- Credit History: Besides having a good credit score, applicants should have a solid credit history. This means a history of responsible credit use and timely payments. American Express will review your credit report as part of the application process.

Customer Care/Support

- Helpline Number: 1800 419 2122, 1800 392 1177

- Official Website: American Express

Final Thoughts

In conclusion, the American Express Platinum Card® is a premium credit card that offers unmatched luxury and travel perks. While its high annual fee of $695 might seem steep, the wide range of benefits easily justifies the cost for frequent travelers. You’ll enjoy exclusive access to airport lounges, travel credits, and hotel perks, which can add significant value. The card also offers impressive rewards on travel-related purchases, including 5X points on flights and prepaid hotels. Additionally, the ability to earn points on Uber rides, digital subscriptions, and other lifestyle benefits makes it a versatile choice for those who value convenience and luxury.

However, the card is best suited for individuals who travel often and can take full advantage of its offerings. If you’re someone who doesn’t travel regularly or prefers earning more points on everyday spending, this card may not be the best fit.

FAQs: The Platinum Card from American Express

Q. What is so special about the American Express Platinum Card?

No foreign transaction fees.

What does American Express Platinum require?

A good to excellent credit score (670+).

What are the benefits of an American Express card?

- Travel protections.

- Benefits for foodies.

- Travel perks.

- Cell phone coverage.

- Free shipping.

- Consumer protections.

What is an Amex Platinum card made of?

Amex platinum is made of stainless steel.

What is the Platinum Card® from American Express?

The Platinum Card® from American Express is a luxury travel rewards credit card that offers exclusive benefits like airport lounge access, travel insurance, and membership rewards points. It's designed for individuals who travel often and seek premium services.

Is it hard to get the Platinum Card® from American Express?

While the Platinum Card® is not challenging for those with excellent credit, the approval process typically requires a high credit score and significant income. Applicants should meet American Express's creditworthiness requirements to increase the chances of approval.

What does it mean if someone has a Platinum American Express Card?

Owning a Platinum American Express Card means you can access exclusive benefits, such as luxury travel rewards, premium concierge services, and enhanced shopping protections. It reflects a high level of financial responsibility and a preference for elite services.

Who gets the American Express Platinum Card?

The American Express Platinum Card is ideal for individuals who travel frequently, spend significantly on luxury items, and want access to premium rewards and services. Business executives, high-net-worth individuals, and frequent flyers often prefer it.

Specification: American Express Platinum Card®: Everything You Need to Know

|